How Different Asset Classes Are Performing

According to Morgan Stanley, US high yield bonds (IGHG) (LQDH) generated a return of 14.4% in 2016.

March 28 2017, Published 12:46 p.m. ET

VanEck

VAN ECK: In fixed income, investors have to deal with this more volatile environment, and we see four different ways they can go with it:

- Number one, you can shorten duration and go shorter-term on your funds.

- Number two, you can go for alternative types of income.

- Number three, you can take more credit risk, which is what we’re most excited about. Buy high yield in the U.S. or emerging markets, for example, and earn higher interest rates as duration bounces around.

- And finally, you can say, “I don’t know what to do,” and invest with an unconstrained bond manager.

BUTCHER: Are you bullish on equities?

VAN ECK: We are indeed bullish on equities. We think the macroeconomic picture is pretty good. While valuations are stretched, which is a slight negative, there is little reason not to be fully allocated. We are as overweight in equities as we have been in the last several years.

Market Realist

In this part of the series, we’ll take a detailed look at different asset classes.

Fixed income class is reliant on shorter duration

According to Morgan Stanley, US high yield bonds (IGHG) (LQDH) generated a return of 14.4% in 2016, US investment grade bonds returned 2.4% in 2016, and emerging market bonds generated a return of 9.3% in 2016. The fixed income asset class is vulnerable to rising Fed rates. The presidential election had an immense contribution towards the falling bond returns. Interest rates rose higher, leading to higher bond yields and lower bond prices. Morgan Stanley has stated that any incremental interest earned could be largely counterbalanced by deteriorating bond prices. Investors are choosing short-term government and corporate bonds despite their low yield over highly valued investment-grade junk bonds.

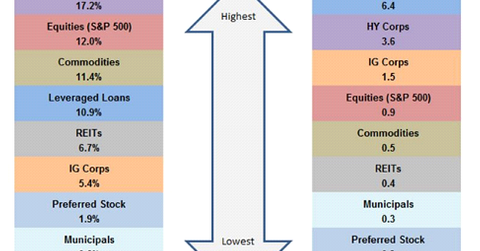

The chart below shows the total returns and the risk-adjusted returns (depicted by the Sharpe Ratio) of the various asset classes. Based on risk-adjusted returns, leveraged loans, high yield corporate bonds, and investment-grade corporate bonds have taken over equities.

Why investors are bullish on equities

Equities have won over investors with their steady and impressive performance since election results. They had already factored in the promises made by Donald Trump in terms of higher GDP growth and job creation via infrastructure spending, Pro-American trade policies, less regulation on banks and healthcare, and lower corporate taxes. The S&P 500 is trading at a forward PE ratio of 18x driven by all its sectors, as is evident from the chart below.

US stocks and emerging market stocks (IEMG) (INDA) had generated returns of 12% and 11% in 2016, respectively, according to Morgan Stanley. The S&P 500 (SPX) (SPY) was mainly driven by the financials sector. European stocks (EZU) (VGK) lost 0.3% while Japanese stocks (EWJ) (DXJ) returned 3% in 2016. As policy uncertainty is gradually receding along with market volatility, the outlook towards equity remains pretty strong considering the positive macroeconomic indicators.

Alternative income classes

VanEck has talked about alternative types of income like real estate (IYR) (VNQ) and commodities. Investment in real estate may help to offset risks associated with rising inflation.