Analyzing the Volatility of Mining Stocks

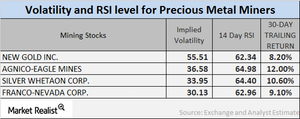

As of April 6, 2017, the volatilities of New Gold (NGD), Agnico Eagle (AEM), Silver Wheaton (SLW), and Franco-Nevada (FNV) were 55.5%, 36.6%, 34%, and 30.1%, respectively.

April 10 2017, Published 5:17 p.m. ET

Precious metal funds

The important figures that precious metal investors should monitor are volatility numbers and RSI levels to understand an asset’s relative undervaluation or overvaluation. In particular, investors should watch RSI levels in the wake of changing precious metal prices.

The leveraged mining funds such as the Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ) rose substantially at the beginning of 2017 due to the revival of precious metals. But more recently, in the past month, these funds and mining shares have started to suffer.

Implied volatility

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than during a stagnant economy.

As of April 6, 2017, the volatilities of New Gold (NGD), Agnico Eagle (AEM), Silver Wheaton (SLW), and Franco-Nevada (FNV) were 55.5%, 36.6%, 34%, and 30.1%, respectively. A mining company’s volatility is often higher than precious metal volatility.

RSI levels

A 14-day RSI above 70 indicates the possibility of a downward movement in a stock’s price. A level below 30 shows the possibility of an upward movement in a stock’s price.

The RSI levels of the four mining giants mentioned above have risen due to higher stock prices. New Gold, Agnico Eagle, Silver Wheaton, and Franco Nevada had RSI levels of 62.3, 65, 64.4, and 62.9, respectively. With rises in the prices of these mining shares, the RSI levels of the stocks have risen.