What Are Analysts’ Recommendations and Forecasts for NBL?

For 4Q16, analysts have an average earnings estimate of -$0.10 per share for Noble Energy (NBL). The low estimate stands at ~-$0.22 per share.

Jan. 27 2017, Updated 5:35 p.m. ET

Analysts’ average, high, and low earnings forecasts for 4Q16

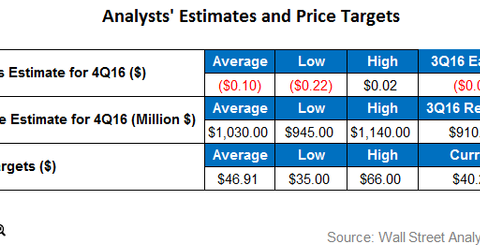

For 4Q16, analysts have an average earnings estimate of -$0.10 per share for Noble Energy (NBL). The low estimate stands at ~-$0.22 per share, and the high estimate stands at $0.02 per share.

The average revenue estimate for NBL is ~$1.0 billion for 4Q16, while the low revenue estimate is ~$945.0 million. The high revenue estimate is ~$1.1 billion.

What are analysts’ price targets for NBL?

Approximately 67% of analysts rate Noble Energy as a “buy,” and 33% rate it as a “hold.” Noble Energy’s high target price is $66, its low target price is $35, and its average target price is $46.91.

Compared to NBL’s current price of $40.23 on January 26, 2017, its average target price implies a return of ~17% in the next 12 months.

Recent upgrades and downgrades for NBL

On January 17, 2017, Seaport Global Securities upgraded its rating for Noble Energy from “sell” to “neutral.” In December 2016, the company downgraded its rating from “neutral” to “sell.”

In comparison, NBL’s peer Cabot Oil & Gas (COG) was recently downgraded. On January 4, 2017, Bank of America Merrill Lynch downgraded COG from “buy” to “underperform.”

In contrast, Antero Resources’ (AR) ratings have been upgraded. Piper Jaffrey and Raymond James upgraded their ratings on January 13, 2017, and January 3, 2017, respectively. Piper Jaffrey upgraded its rating from “neutral” to “overweight,” and Raymond James upgraded its rating from “outperform” to “strong buy.”

NBL is a component of the SPDR S&P North American Natural Resources ETF (NANR). NANR invests 0.75% of its portfolio in Noble Energy.