What Wall Street Analysts Are Saying about ConocoPhillips

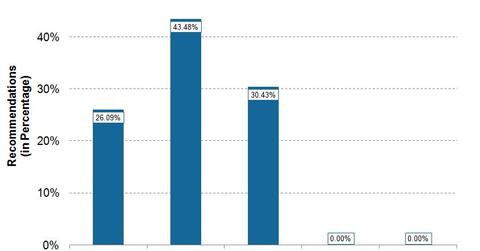

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips.

Aug. 3 2017, Updated 7:36 a.m. ET

Recommendations

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips. As of July 28, 23 analysts provide recommendations on ConocoPhillips. These recommendations include six “strong buys,” ten “buys,” and seven “holds.” ConocoPhillips’s stock has no “sell” or “strong sell” recommendation.

Target price

The median target price for COP’s stock from the above-mentioned Wall Street analyst recommendations is $54.00, which is ~19% higher than the July 28 closing price of $45.26.

The mean target price for COP from these recommendations is $52.26, which is lower than the median target price.

How COP’s recommendations have changed since 2Q17 earnings

Since 2Q17 earnings, analysts’ “strong buy” recommendations for COP have risen from five to six, “buy” recommendations have fallen from 11 to ten, and “hold” recommendations have fallen from eight to seven. The recommendations with “sell” and “strong sell” ratings have remained unchanged.

Since 2Q17 earnings, ConocoPhillips’s median target price remained unchanged, whereas COP’s mean target price has fallen from $52.58 to $52.26.

Other oil and gas producers

Based on the mean price targets of recommendations from Wall Street analysts’ other oil and gas companies, like Southwestern Energy (SWN) and EOG Resources (EOG), have potential upsides of ~58% and ~9%, respectively, from their July 28 closing prices. Cobalt International Energy (CIE) has a potential upside of ~58%. Southwestern Energy is a natural gas producer, whereas EOG is mainly a crude oil producer. CIE operates in the offshore oil and gas exploration domain. The Energy Select Sector SPDR ETF (XLE) generally invests at least 95% of its total assets in oil and gas companies.