Newell Brands Announces Its New Acquisition Plans

Price movement Newell Brands (NWL) rose 1.4% to close at $46.18 per share during the second week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.4%, -1.2%, and 6.5%, respectively, as of December 16. NWL is trading 1.1% below its 20-day moving average, 5.0% below its 50-day moving average, […]

Dec. 20 2016, Updated 7:37 a.m. ET

Price movement

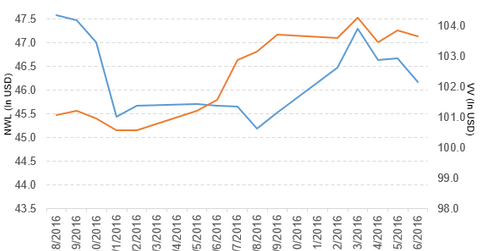

Newell Brands (NWL) rose 1.4% to close at $46.18 per share during the second week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.4%, -1.2%, and 6.5%, respectively, as of December 16. NWL is trading 1.1% below its 20-day moving average, 5.0% below its 50-day moving average, and 4.1% below its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.12% of its holdings in Newell Brands. The YTD price movement of VV was 12.6% on December 16. The market caps of Newell Brands’ competitors are as follows:

Latest news on NWL

In a press release on December 12, 2016, Newell Brands reported that “it has entered into a definitive agreement to acquire New Zealand-based Sistema Plastics, a leading provider of innovative food storage containers, primarily under the Sistema brand, for NZ$660 million (US$470 million). Additionally, the company has entered into a definitive agreement to acquire Smith Mountain Industries, a leading provider of premium home fragrance products, primarily under the WoodWick Candle brand, for $100 million. Both businesses are growing at rates well above Newell Brands’ core sales growth rate and are expected to be immediately accretive to normalized earnings.”

Performance of Newell Brands in 3Q16

Newell Brands (NWL) reported 3Q16 net sales of $4.0 billion, a rise of 158.5% over the net sales of $1.5 billion in 3Q15, due to the acquisition of Jarden. The company’s gross profit margin and operating income narrowed by 690 basis points and 400 basis points, respectively, between 3Q15 and 3Q16.

Its net income rose to $186.5 million and its EPS (earnings per share) fell to $0.38 in 3Q16, compared with $134.2 million and $0.50, respectively, in 3Q15. It reported non-GAAP[1. generally accepted accounting principles] normalized EPS of $0.78 in 3Q16, a rise of 25.8% over 3Q15.

NWL reported cash and cash equivalents and inventories of $670.0 million and $2.4 billion, respectively, in 3Q16, compared with $266.2 million and $898.8 million in 3Q15. Its current ratio rose to 1.9x and its debt-to-equity ratio fell to 2.0x in 3Q16, compared with 1.1x and 2.7x, respectively, in 3Q15.

Quarterly dividend

Newell Brands (NWL) has declared a quarterly cash dividend of $0.19 per share on its common stock. The dividend will be paid on December 15, 2016, to shareholders of record at the close of business on November 30, 2016.

Projections

Newell Brands has made the following projections for fiscal 2016:

- reported net sales growth of 122.5%–128.0%

- reported EPS of $1.15–$1.20

- core sales growth of 3.5%–4.0%

- normalized EPS of $2.85–$2.90

The company has made the following projections for fiscal 2017:

- core sales growth of 3%–4%

- normalized EPS of $2.85–$3.05

Next, we’ll look at BorgWarner (BWA).