Fortune Brands Home & Security Inc

Latest Fortune Brands Home & Security Inc News and Updates

Newell Brands Declares Dividend of $0.19 per Share

Newell Brands (NWL) reported 3Q16 net sales of $4.0 billion, a rise of 158.5% over the net sales of $1.5 billion in 3Q15, due to the acquisition of Jarden.

Why Is Newell Brands Selling Its Tool Business?

Newell Brands reported 2Q16 net sales of $3.9 billion—a rise of 143.8% compared to net sales of $1.6 billion in 2Q15.

Newell Brands Reaffirms Its Fiscal 2016 Projections

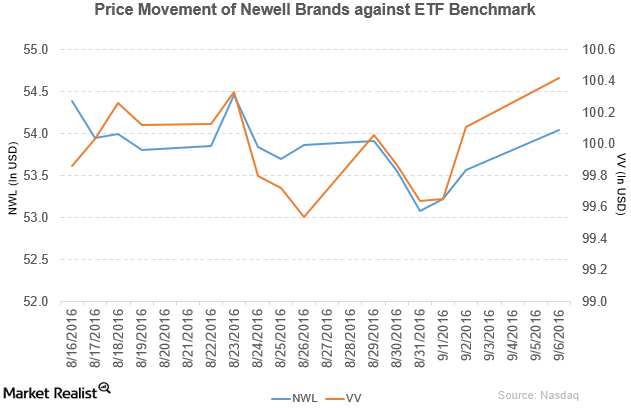

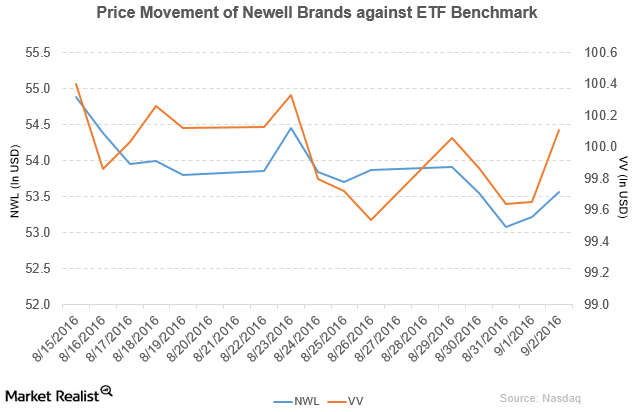

Newell Brands (NWL) has a market cap of $25.9 billion. It rose by 0.88% to close at $54.04 per share on September 6, 2016.

Newell Brands Plans Its Growth Strategies

In 2Q16, Newell Brands’s net income and earnings per share fell to $135.2 million and $0.30, respectively, compared with $148.5 million and $0.55, respectively, in 2Q15.

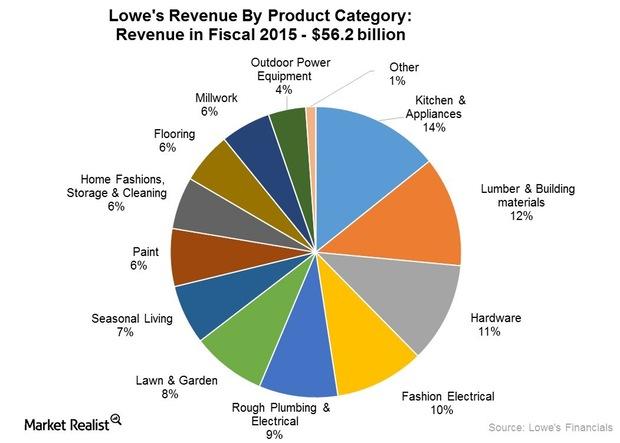

Analyzing Lowe’s Merchandise and Services Assortment

Lowe’s sources its merchandise from over 7,000 suppliers with no supplier accounting for more than 6% of sales.

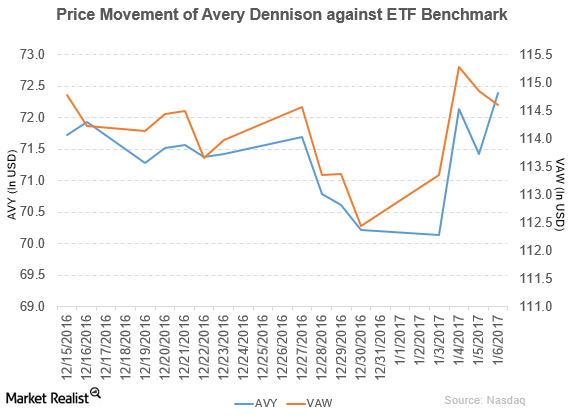

Citigroup Upgrades Avery Dennison to a ‘Buy’

Avery Dennison rose 1.4% to close at $72.40 per share on January 6. The stock’s weekly, monthly, and YTD price movements were 2.5%, -1.1%, and 3.1%.

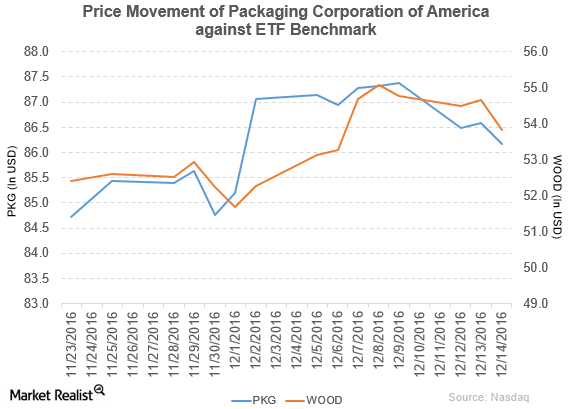

Packaging Corporation of America Declares Dividend of $0.63 Per Share

PKG fell 0.50% to close at $86.16 per share on December 14. The stock’s weekly, monthly, and YTD price movements were -1.3%, 0.22%, and 40.3%.

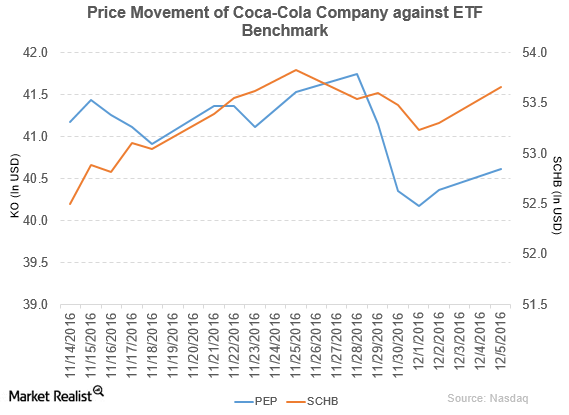

Coca-Cola Announces Its Expansion Plans

Coca-Cola’s net income and EPS fell to $1.0 million and $0.24, respectively, in 3Q16, compared to $1.4 million and $0.33 in 3Q15.

Newell Brands Will Reaffirm Its Projections

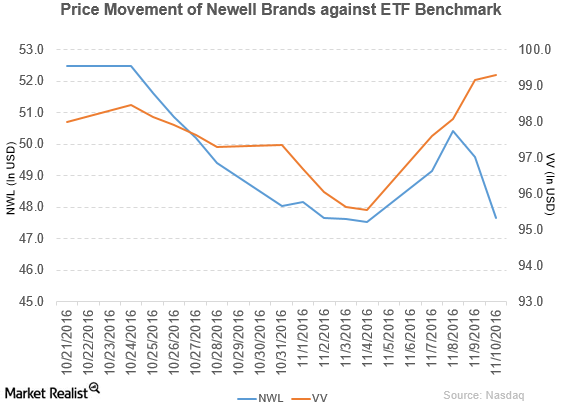

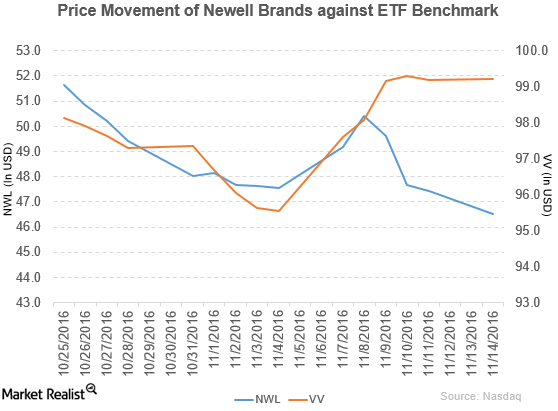

Newell Brands (NWL) has a market cap of $23.3 billion. It fell 2.0% to close at $46.51 per share on November 14, 2016.

Raymond James Upgrades Newell Brands to ‘Strong Buy’

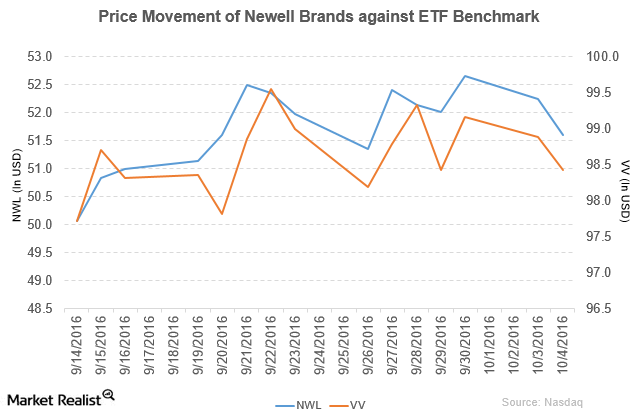

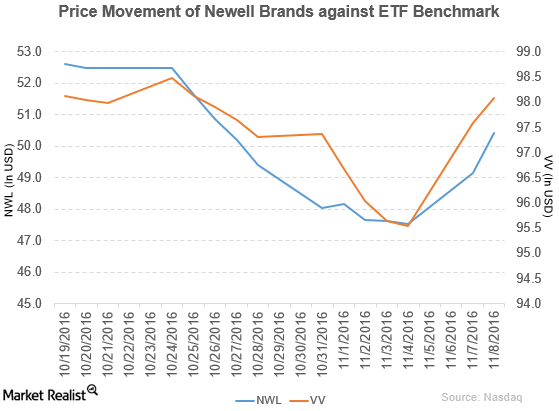

Price movement Newell Brands (NWL) has a market cap of $24.3 billion. It rose 2.5% to close at $50.41 per share on November 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.7%, -1.8%, and 15.8%, respectively, on the same day. NWL is trading 0.33% below its 20-day moving average, 2.1% […]

Wells Fargo Rates Mohawk Industries as ‘Market Perform’

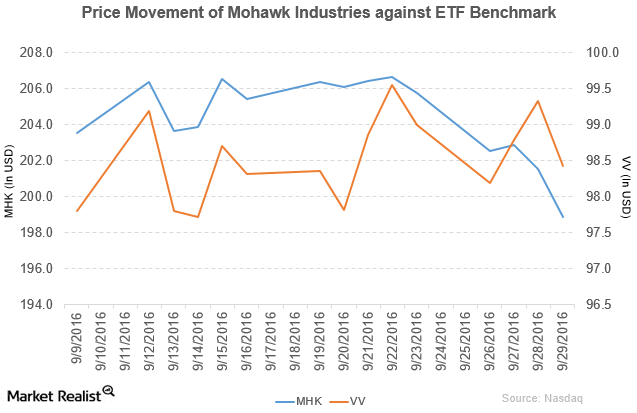

Price movement Mohawk Industries (MHK) has a market cap of $14.8 billion. It fell 1.3% to close at $198.86 per share on September 29, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -3.8%, -6.1%, and 5.0%, respectively, on the same day. MHK is trading 4.2% below its 20-day moving average, 4.6% […]

Bank of America Merrill Lynch Rates Mohawk Industries ‘Neutral’

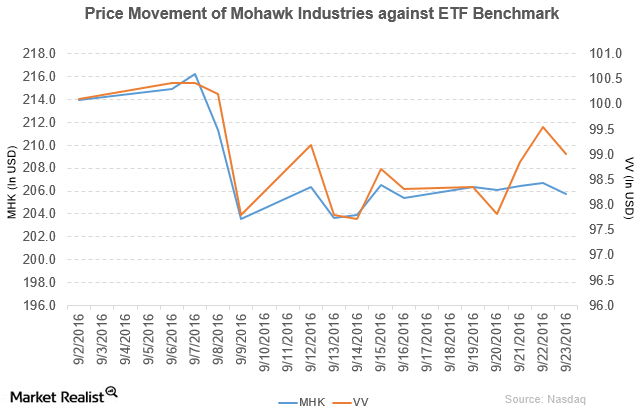

Price movement Mohawk Industries (MHK) has a market cap of $15.3 billion. It fell 0.45% to close at $205.75 per share on September 23, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.16%, -2.2%, and 8.6%, respectively, on the same day. MHK is trading 1.6% below its 20-day moving average, 1.1% […]

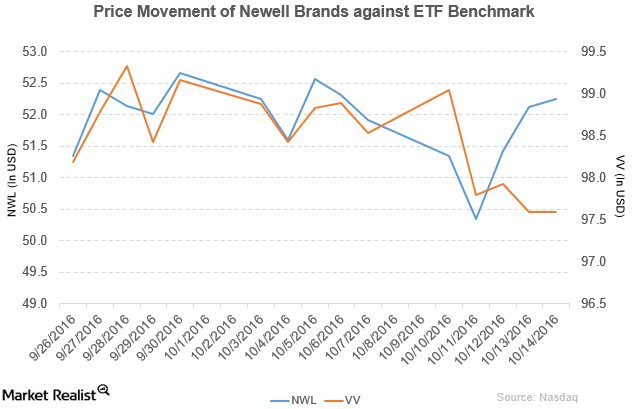

Newell Brands Makes Changes in Its Management

NWL fell by 0.20% to close at $53.57 per share during the fifth week of August, with weekly, monthly, and YTD price movements of -0.20%, 0.90%, and 23.1%.

Newell Brands Declares Quarterly Dividend of $0.19 Per Share

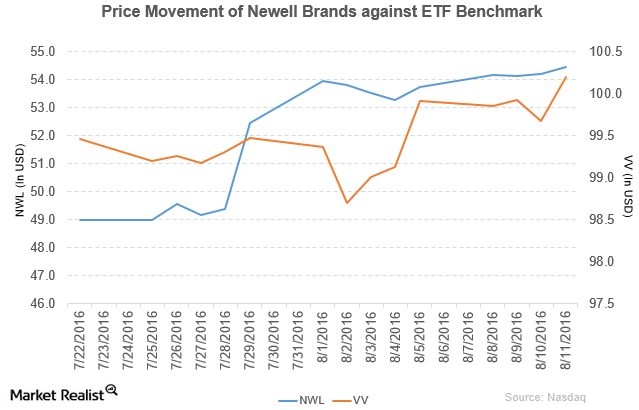

Newell Brands (NWL) has a market cap of $27.1 billion. It rose by 0.52% to close at $54.47 per share on August 11, 2016.

A Look at Newell Brands’ Performance in 2Q16

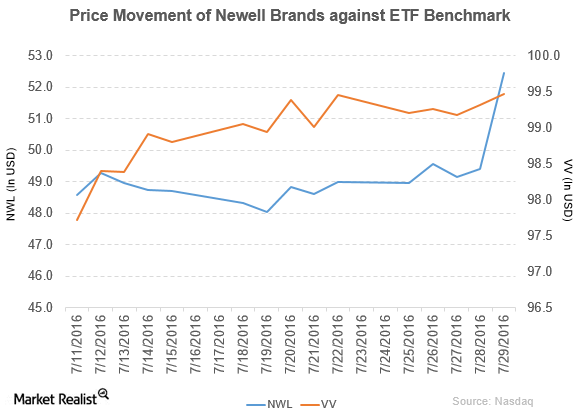

Newell Brands (NWL) has a market capitalization of $25.6 billion. It rose by 6.2% to close at $52.46 per share on July 29, 2016.

Newell Brands Sold Its Brands to Hunter Douglas

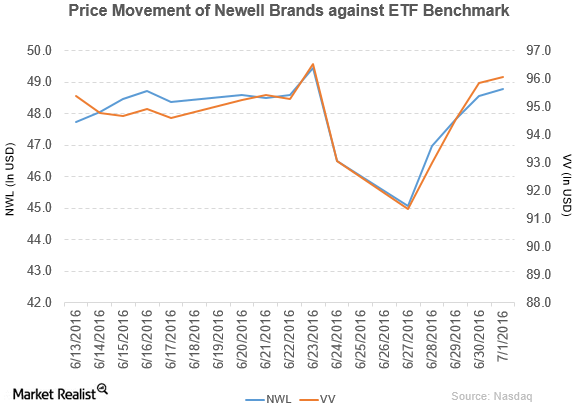

Newell Brands (NWL) has a market capitalization of $24.0 billion. It rose by 0.43% to close at $48.78 per share on July 1, 2016.

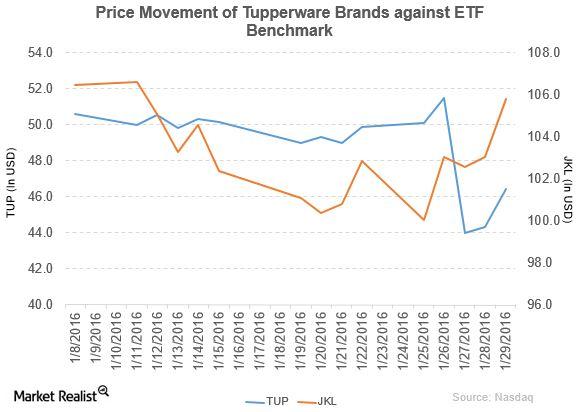

Tupperware Brands’ Revenue and Income Fell in 4Q15

Tupperware Brands (TUP) fell by 6.9% to close at $46.43 per share at the end of the last week of January 2016.