Why Did Sunrun Miss Analysts’ 3Q16 Revenue Estimates?

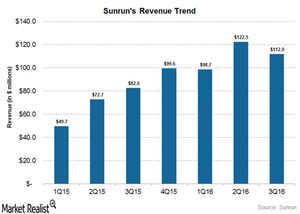

For 3Q16, Sunrun’s (RUN) consolidated revenue came in at ~$112 million against analysts’ expectations of $135 million.

Dec. 4 2020, Updated 10:53 a.m. ET

Segment-wise revenue

Sunrun (RUN) reports its revenue under the following two operating segments:

- Operating Leases and Incentives

- Solar Energy Systems and Product Sales Segments

For 3Q16, Sunrun (RUN) reported ~$43.2 million in revenue from its Operating Leases and Incentives segment compared to ~$31.7 million in 3Q15 and ~$45.4 million in 2Q16. Revenue from the Solar Energy Systems and Product Sales segment came in at ~$68.6 million compared to ~$51.0 million in 3Q15 and ~$77.1 million in 2Q16.

Revenue under the Operating Leases and Incentives segment mainly included proceeds from customer agreements, solar energy system rebate incentives, and sales of SRECs (Solar Renewable Energy Certificates). It also includes revenue associated with ITCs (investment tax credits) assigned to investment funds that are classified as lease pass-through arrangements.

Revenue under Solar Energy Systems and Product Sales mostly included proceeds from the sale of solar (TAN) panels, inverters, racking systems, and other solar-related equipment to resellers.

Sunrun’s overall revenue

For 3Q16, Sunrun’s (RUN) consolidated revenue came in at ~$112 million against analysts’ expectations of $135 million. The company reported consolidated revenue of $123 million in 2Q16 and $83 million in 3Q15.

Why was there a deviation?

Sunrun’s (RUN) revenue can fluctuate depending on channel partner mix, revenue recognized from solar incentives, and cash and third-party loan sales. According to the company’s earnings call, RUN’s cash and third-party loan mix was ~10% compared to 16% in 2Q16. This decrease was primarily due to higher channel partner mix that includes only lease systems.

The company reported its incentives revenue at $9.0 million compared to $12.4 million during 2Q16. Lower-than-expected solar energy systems sales and lower incentives revenue resulted in lower-than-anticipated revenue during 3Q16.

It is important to note that the recognition of revenue from solar incentives such as SRECs (solar renewable energy certificates) and ITCs (investment tax credits) depends on market conditions. As a result, revenue recognized from these incentives by downstream solar companies such as Vivint Solar (VSLR), Sunrun (RUN), SolarCity (SCTY), and SunPower (SPWR) can fluctuate from quarter to quarter.

Next, we’ll look at Sunrun’s cost performance in 3Q16.