Why Are Water ETFs Yielding More than Water Utilities?

Water utility ETFs (exchange-traded funds) yield approximately 100–150 basis points more than what water utility companies yield.

Nov. 15 2016, Updated 4:04 p.m. ET

Water ETFs

Water utility ETFs (exchange-traded funds) yield approximately 100–150 basis points more than what water utility companies yield. A major part of the additional yields that water ETFs obtain likely comes from their investments in the industrial sector.

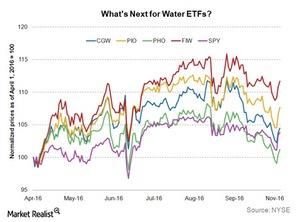

The chart above shows the comparative price movement of water ETFs from the start of 2Q16. The Guggenheim S&P Water Index ETF (CGW), the PowerShares Water Resources Portfolio (PHO), the PowerShares Water Resources Portfolio (PIO), and the First Trust ISE Water Index ETF (FIW) are four leading water utility funds that invest in water-related businesses in the US and beyond.

Continue to the next and final part of the series for a wrap-up of our discussion of the position of US water utilities as long-term investments.