PowerShares Global Water ETF

Latest PowerShares Global Water ETF News and Updates

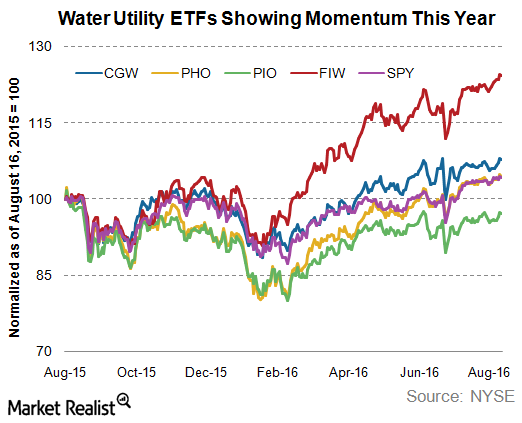

Why Do Water ETFs Yield More Than Water Utilities?

Water utility ETFs (exchange-traded funds) yield roughly 100–150 basis points more than what water utility holding companies yield.

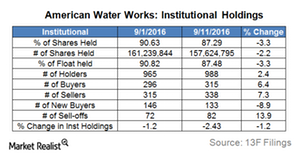

What Are Institutional Investors Doing with American Water Works Holdings?

Institutional investors have decreased their positions in American Water Works (AWK) in the past couple of months.

Why Are Water ETFs Yielding More than Water Utilities?

Water utility ETFs (exchange-traded funds) yield approximately 100–150 basis points more than what water utility companies yield.

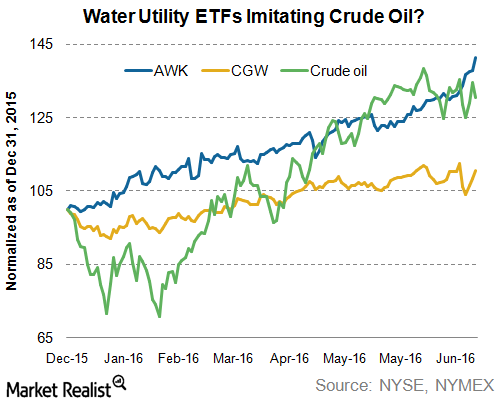

What Does the Correlation between Water Utilities and Crude Oil Mean?

Investors may find water utilities attractive due to their yields and stable earnings growth. However, they may not be as safe as they seem.

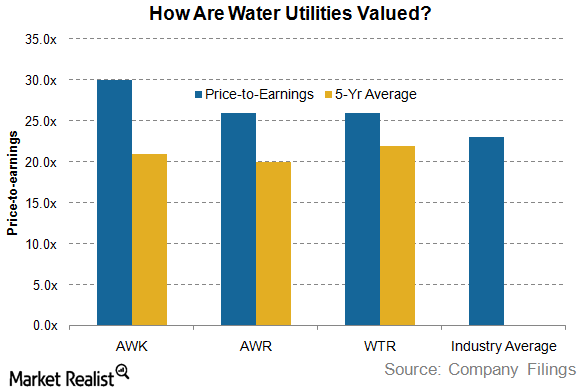

Are US Water Utilities Fairly Valued?

It seems that US water utilities are trading at a premium compared electric utilities.