Which Sectors to Invest in If Donald Trump Wins

When Republican George H.W. Bush was elected president, the S&P 500 rose 8.5% three months after the election. It had a return of 11.2% six months after the election.

Nov. 8 2016, Published 9:34 a.m. ET

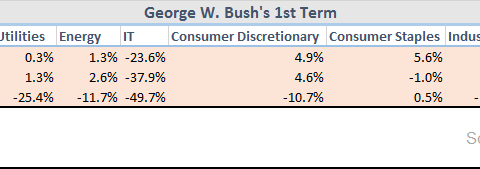

Sectors during George W. Bush’s presidency

The S&P 500 index and the sectors have been somewhat more generous to the Democrats, but let’s see which sectors are pro-Republican.

Three months after Republican George W. Bush was elected president, the S&P 500 index fell 6.4%. The fall was driven by negative returns from every sector except materials, consumer, energy, financials, and utilities. IT (information technology) was hit the worst, falling 24.0%, but that was triggered by the Y2K (year 2000) bug.

Six months after Bush’s election, the index fell 11.8%, driven by negative returns from all sectors except materials (GDX) (NUGT) (GDXJ), consumer discretionary, energy, and utilities. IT continued to be the worst performing sector with a return of -38.0%.

After one year, the index had a return of -22.1%, driven by negative returns from all sectors except materials and consumer staples. IT recorded the biggest fall of 50.0%.

Bush’s incumbency factor

The S&P 500 index generated a return of 5.5% three months after Bush’s reelection, driven by positive returns from every sector except telecommunications. Energy (XOP) (XLE) reported the highest return, followed by utilities with a return of more than 10.0%. IT recorded the lowest return of less than 2.0%.

Six months after Bush’s reelection, the S&P 500 fell and recorded a return of 2.8%, mainly driven by energy with a return of 19.0%. Next came utilities and healthcare with returns of more than 10.0%. The other sectors recorded negative returns except consumer staples, materials, and industrials.

The index bounced back with a return of 7.4% one year after Bush’s reelection. The growth was driven mainly by energy with a return of 37.0%. Utilities returned 19.0%. Telecommunications and consumer discretionary were the only sectors with negative returns.

Sectors during George H.W. Bush’s presidency

When Republican George H.W. Bush was elected president, the index rose 8.5% three months after the election. The index generated a return of 11.2% six months after the election.

One year after the election, the index doubled to 22.9%. The S&P 500 yielded a return of -2.5% during the two months that ended November 10, 1989. Healthcare (LABD) (LABU) led with a return of 5.0%, followed by telecommunications, utilities, and consumer staples. The rest had negative returns, led by IT.

In the next and final part of our series, we’ll try to identify the best-performing sectors.