KeyBanc Capital Markets Upgrades Fossil to ‘Overweight’

Fossil Group (FOSL) has a market cap of $1.6 billion. It rose 8.4% to close at $35.70 per share on November 16, 2016.

Nov. 20 2020, Updated 12:39 p.m. ET

Price movement

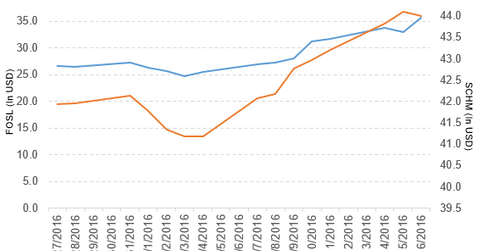

Fossil Group (FOSL) has a market cap of $1.6 billion. It rose 8.4% to close at $35.70 per share on November 16, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 27.2%, 27.4%, and -2.4%, respectively, on the same day.

FOSL is trading 25.9% above its 20-day moving average, 26.2% above its 50-day moving average, and 6.5% above its 200-day moving average.

Related ETF and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.05% of its holdings in Fossil Group. The ETF tracks a market cap–weighted index of mid-cap stocks in the Dow Jones US Total Stock Market Index. The YTD price movement of SCHM was 11.0% on November 16.

The market caps of Fossil Group’s competitors are as follows:

Fossil Group’s rating

On November 16, 2016, KeyBanc Capital Markets upgraded Fossil Group’s rating to “overweight” from “sector weight” and set the stock’s price target at $42.0 per share.

TheStreet reported, “KeyBanc estimates that the strong reception to new wearables will drive $175 million to $25 million in revenue for Fossil and 50 cents in per-share earnings over the next year.”

The report added, “KeyBanc claims that the Fossil and Skagen brands are “an underappreciated element of the Fossil story.” Each of these lifestyle brands could generate $1.3 billion in revenue, representing between $2.0 billion and $2.4 billion in enterprise value, the firm said.”

Performance of Fossil Group in 3Q16

Fossil Group reported fiscal 3Q16 net sales of $738.0 million, a fall of 4.3% compared to its net sales of $771.3 million in 3Q15. Sales of the company’s Americas and Europe business segments fell 7.7% and 6.6%, respectively, and sales of its Asia business segment rose 11.5% in 3Q16 compared to 3Q15.

The company’s gross profit margin and operating margin contracted 200 basis points and 560 basis points, respectively, in 3Q16 compared to 3Q15.

Its net income and EPS (earnings per share) fell to $17.4 million and $0.36, respectively, in 3Q16, compared to $57.5 million and $1.19, respectively, in 3Q15.

Fossil Group’s cash and cash equivalents fell 18.4%, and its inventories rose 11.9% in 3Q16 compared to 4Q15. Its current ratio rose to 3.3x, and its debt-to-equity ratio fell to 1.3x in 3Q16, compared to its current and debt-to-equity ratios of 2.9x and 1.5x, respectively, in 4Q15.

Projections

Fossil Group has made the following projections for 4Q16:

- net sales growth of -2.0%–4.0%

- operating margin of 5.8%–8.5%

- EPS of $0.69–$1.19

The company has made the following projections for 2016:

- net sales growth of -5.0% to -3.0%

- operating margin of 4.0%–5.0%

- EPS of $1.30–$1.80

For an ongoing analysis of this sector, visit Market Realist’s Consumer Discretionary page.