How Did Bunge Perform in 3Q16?

Bunge (BG) has a market cap of $9.6 billion. It rose 10.0% to close at $68.81 per share on November 2, 2016.

Nov. 4 2016, Updated 8:05 a.m. ET

Price movement

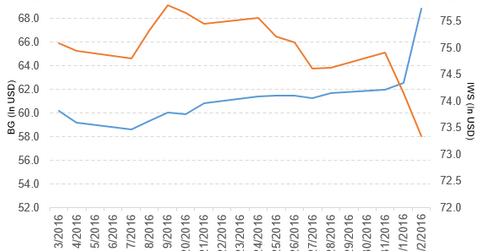

Bunge Limited (BG) has a market cap of $9.6 billion. It rose 10.0% to close at $68.81 per share on November 2, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 11.9%, 14.9%, and 2.9%, respectively, on the same day. BG is trading 13.2% above its 20-day moving average, 12.4% above its 50-day moving average, and 15.6% above its 200-day moving average.

Related ETF and peers

The iShares Russell Mid-Cap Value ETF (IWS) invests 0.26% of its holdings in Bunge Limited. The ETF tracks an index of US mid-cap value stocks. The index selects from the bottom 80% of the Russell 1000, screening on value factors. The YTD price movement of IWS was 8.5% on November 2.

The market cap of Bunge’s competitors are as follows:

Performance of Bunge in 3Q16

Bunge Limited reported 3Q16 net sales of $11.4 billion, a rise of 5.6% compared to net sales of $10.8 billion in 3Q15. Sales from agribusiness, edible oil products, milling products, sugar and bioenergy, and fertilizer segments rose 4.5%, 4.1%, 14.7%, 20.5%, and 8.4%, respectively, in 3Q16 compared to 3Q15. The company’s gross profit margin and total segment EBIT (earnings before interest and tax) margin fell by 200 basis points and 190 basis points, respectively, in 3Q16 compared to the prior-year period.

Its net income and EPS (earnings per share) fell to $116.0 million and $0.83, respectively, in 3Q16 compared to $229.0 million and $1.56, respectively, in 3Q15.

Bunge’s cash and cash equivalents fell 27.7%, and its inventories rose 15.8% in 3Q16 compared to 4Q15. Its current ratio fell to 1.4x, and its debt-to-equity ratio rose to 1.8x in 3Q16 compared to a current ratio and a debt-to-equity ratio of 1.5x and 1.7x, respectively, in 4Q15.

Projections

Bunge Limited has made the following projections for fiscal 2016:

- EBIT for food and ingredients of $230 million to $240 million

- EBIT for fertilizer of ~$30 million

- EBIT for sugar and bioenergy of $60 million to $70 million

Quarterly dividend

Bunge has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

The company has also declared a quarterly cash dividend of $1.22 per share on its 4.9% cumulative convertible perpetual preference shares. The dividend will be paid on December 1, 2016, to shareholders of record on November 15, 2016.

Next, we’ll look at Sonoco Products (SON).