Why All the Talk about Tapering in Europe?

It’s important to remember that the ECB (European Central Bank) hasn’t officially announced that it’s discussing tapering

Oct. 7 2016, Updated 7:04 p.m. ET

Just one of the options

It’s important to remember that the ECB (European Central Bank) hasn’t officially announced that it’s discussing tapering. Since the discussion has been informal, the officials who have talked to Bloomberg remain anonymous.

Secondly, the talk of winding down stimulus, á la the US Federal Reserve, is important. The ECB will have internally discussed ways of dealing with the situation when it does end its bond-buying program. They have just two options:

- Stop purchasing any bonds immediately at the end of the program.

- Wind down its purchases when it feels bond buying has run its course.

Taking the latter approach is more fruitful, as it saves the market from any jolt and also gives policymakers enough room to scale up stimulus if the economic situation worsens. It’s important to note that ECB chief Mario Draghi has maintained that the central bank may extend its bond-buying program beyond March 2017 if need be, and likely, it will need to, especially considering the fallout from Brexit.

Good feedback to the ECB

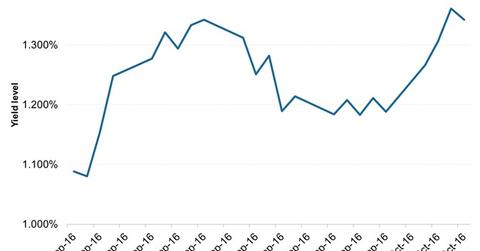

One good thing that has come out of this talk about tapering stimulus is the market reaction to the unconfirmed hypothesis. Though the ECB may not have intended this news to come out, the market reaction provides excellent feedback to the central bank about what could happen if it does announce plans to scale back its bond buying.

Eventual monetary tightening would likely result in a rise in yields in ETFs like the SPDR Barclays International Treasury Bond ETF (BWX) and the iShares International Treasury Bond ETF (IGOV), and investors would likely need to move to shorter duration bonds and ETFs like the SPDR Barclays Short Term International Treasury Bond ETF (BWZ) and the iShares 1-3 Year International Treasury Bond ETF (ISHG). A general increase in interest rates could be beneficial to the region’s banks (BBVA) and insurance companies (ING) (AEG).

In the next article, we’ll look at why markets are so worried about ECB tapering.