ING Groep N.V.

Latest ING Groep N.V. News and Updates

Should You Look to European Stocks for Growth?

European stocks began the year with a lot of hope pinned on them for providing capital appreciation in the year.

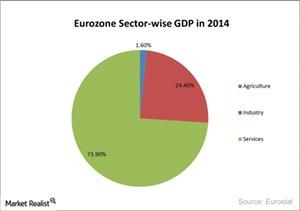

Analyzing the European Union’s GDP Composition

The EU’s (European Union) GDP (gross domestic product) depends on the service sector. The service sector contributes ~73.90% towards the EU’s (EZU) GDP.