Richard Bernstein: Don’t Fear the Bear Market

A legitimate bull market In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy. In the […]

Oct. 24 2016, Updated 8:06 a.m. ET

A legitimate bull market

In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy.

In the October article, he states that “it’s just a bull market. Get over it.” What he’s trying to say is that this is a genuine and typical bull market and investors should let go of their fears of an immediate slump and invest.

He notes that when Richard Bernstein Advisors was formed in 2009, he and his colleagues believed that the US equity market (FVD) (SPHD) was entering one of the biggest bull runs of their careers. He states that the current bull run is the second largest in the post-war era and that it’s not over yet. The firm believes that “the bull market will be one for the record books by the time it is over.”

Fundamentals in place

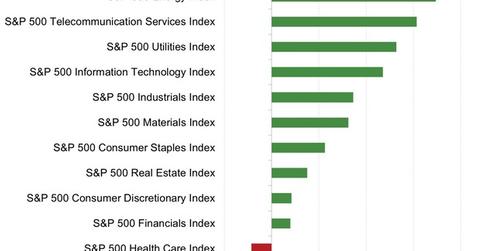

In earlier newsletters, Richard Bernstein has noted that this bull market is earnings driven and not interest rate driven. During an earnings-driven market, portfolio construction needs to focus on PE (price-to-earnings) multiple contraction. PE- multiple contraction during this type of bull market needs to be due to rising earnings per share rather than falling prices. Cyclical stocks do better than stable companies’ stocks. Automakers (GM) (FCAU), airlines (AAL) (LUV), and hotels (HLT) (MAR) are good examples of cyclical stocks.

On the other hand, in a falling interest rate environment, the PE multiple rises because investors are keen on increasing the time horizon of their investments. In this type of a bull market, stable growth companies tend to outperform cyclical companies, and higher PE multiples need to be because of a rise in price rather than a decline in earnings.

Fear continues to rule the minds of investors for now. We’ll have to wait and see whether advice like this can shake it off.