Why Gold ETFs See Robust Net Inflows against Actively Managed Gold Funds

One of the dominant financial trends of the past decade has been a move by investors out of actively managed funds and into passively managed index funds or exchange traded funds (ETFs).

Nov. 20 2020, Updated 11:32 a.m. ET

Actively Managed Gold Funds versus Gold ETFs

One of the dominant financial trends of the past decade has been a move by investors out of actively managed funds and into passively managed index funds or exchange traded funds (ETFs). The latest example is the Illinois State Pension Board, which according to The Wall Street Journal, decided to jettison active mutual fund managers altogether, leaving only passively managed choices for its state workers. The reasons cited for the move into ETFs included lower fees and potentially better performance as many active managers fail to outperform their passive peers. We have witnessed this recent preference for ETFs here at VanEck. This year we have seen strong net inflows into VanEck Vectors™ Gold Miners ETF (GDX), while our actively managed VanEck International Investors Gold Fund (INIVX) has experienced small net outflows.

Although both actively and passively managed options, including INIVX and GDX (and their respective peers), provide investors leveraged access to the gold market, there are distinct characteristics of each that must align with an investor’s objective in making a decision to add gold mining exposure. All gold equity investment options may not provide the same benefits.

Market Realist – Intra-day volatility advantage

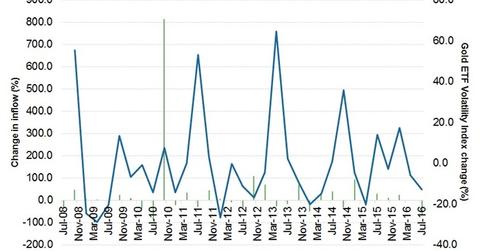

There are many ways to gain exposure to gold (GDX), including ETFs and exchange-traded commodities, or ETCs, such as the iShares Physical Gold ETC (SGLN). Gold ETFs or ETCs give you direct exposure to gold prices, backed by physical gold bars held in a vault. ETFs are easy to buy and sell on a stock exchange, like a share. However, selling gold funds at any time isn’t guaranteed, and shares of precious metal companies are generally more volatile (VIXY) than most other asset classes—like high-yield corporate bonds (JNK) and Treasuries (TLT) (UST).

Therefore, investors can take advantage of intra-day volatility in gold prices when trading in ETFs. The VanEck Merk Gold Trust ETF (OUNZ) and the iShares Gold Trust ETF (IAU) are some gold-traded ETFs.