Could JetBlue’s Valuation Change after 3Q16?

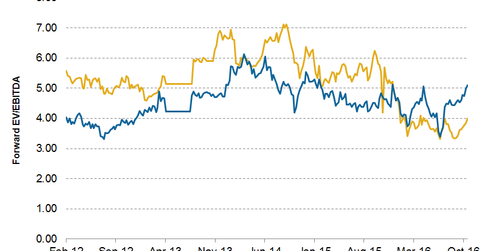

Currently, JetBlue Airways (JBLU) is valued at 4x its forward EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

Oct. 28 2016, Updated 10:04 a.m. ET

JetBlue’s current valuation

Currently, JetBlue Airways (JBLU) is valued at 4x its forward EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple. This valuation is lower than its average valuation of 4.8x since September 2009.

Peer comparison

Spirit Airlines (SAVE) is trading at 6.8x, Allegiant Travel (ALGT) at 6.7x, American Airlines (AAL) at 5.3x, Southwest Airlines (LUV) at 5.2x, Delta Air Lines (DAL) at 4.7x, Alaska Air (ALK) at 5.1x, and United Continental (UAL) at 4.6x.

The market is expecting DAL to record EBITDA growth of 8.2% in the next year. AAL’s EBITDA are expected to fall 5%, UAL’s are expected to fall 8%, ALK’s are expected to grow 6%, LUV’s are expected to grow 1%, JBLU’s are expected to grow 8%, SAVE’s are expected to fall -3%, and ALGT’s are expected to grow 1%.

Our analysis

JetBlue’s high-value geography, maturing markets, and premium product have helped it grow in the past. It operates in airports with controlled gates and slots, limiting competition. JBLU’s low-cost structure and strong domestic presence position it well to outperform peers. These advantages, along with its innovative services like “Mint,” should help the company grow.

However, concerns over declining unit revenue and rising unit costs could keep plaguing the stock in the short term. Also, given OPEC’s agreement to reduce fuel output, fuel costs have already risen to $50 per barrel. If fuel costs continue to rise and airlines aren’t able to pass them on, they will impact valuation multiples.

JBLU’s ability to turnaround its yield performance and maintain leverage at the same time will be key to changing valuation multiples in the short term. JBLU forms ~0.8% of the iShares S&P Mid-Cap 400 Growth ETF (IJK).