Why Some Popular Positions Become Risky

According to Factset data, around 93% of companies in the utilities (JXI) sector and 80% in the telecom (IXP) sector reported revenues below estimates in the second quarter of 2016.

Sept. 8 2016, Updated 1:56 p.m. ET

We advocate reducing popular positions where prices have moved beyond fundamentals (examples are gilts and bond-proxies such as utility stocks). We also would resist taking contrarian positions in sectors facing big structural challenges (e.g., European banks).

Market Realist – Some positions have moved beyond fundamentals

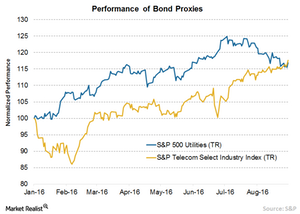

Popular investments not supported by fundamentals and that have rallied sharply over the past few months look risky. As we discussed in the previous article, government bonds issued by developed markets and bond proxies belong in this category.

Bond proxies

A bond proxy is an investment that provides higher and more stable yields with lower risk. The telecom (IYZ) and utilities (IDU) sectors are normally considered bond proxies. The S&P Telecom Select Industry Index TR is up by 15.8% YTD while the S&P 500 Utilities Index TR is up by 16.6%.

However, past performance doesn’t guarantee consistent future performance unless it is backed by strong financials and the ability to generate higher cash flows. Both of these sectors haven’t shown any robust improvement in growth.

According to Factset data, around 93% of companies in the utilities (JXI) sector and 80% in the telecom (IXP) sector reported revenues below estimates in the second quarter of 2016.

European banks

Very low to negative interest rates, huge bad loans, some banks falling short of stress tests, and tough EU bail-in laws have all affected European banks this year. While banks in Italy are on the verge of crisis, other banks in the region are not far behind. Hence, investors need to be cautious when taking exposure to European banks (EUFN).