Looking at US Truckload Carriers through Analysts’ Eyes

In this part of the series, we’ll take a look at what Wall Street analysts are saying about US truckload carriers and how they’re rating the stocks.

Sept. 16 2016, Updated 8:04 a.m. ET

Analysts’ recommendations

In the previous part of the series, we saw the direction of the Truck Tonnage Index in July 2016. Now we’ll take a look at what Wall Street analysts are saying about US truckload carriers.

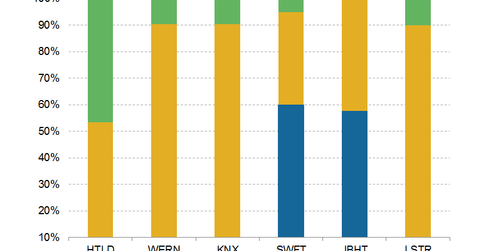

The rating scale ranges from 1 to 5. A rating of 1 implies a “strong sell,” and a rating of 5 means a “strong buy.” We’ll also see how many analysts are rating each stock as a “buy,” a “sell,” or a “hold.”

Heartland Express

Heartland Express (HTLD) has a Wall Street analyst consensus rating of 2.2, or a “hold.” Of the 15 analyst recommendations, only one gave it a “buy,” seven gave it a “hold,” and seven gave it a “sell.” HTLD’s average 12-month price target is $17.10 compared to its market price of $19.20 on September 2, 2016.

Werner Enterprises

Werner Enterprises (WERN) has a Wall Street analyst consensus rating of 3, or a “hold.” Of the 21 analysts covering the stock, two gave it a “buy,” and 17 gave it a “hold.” WERN’s average 12-month price target is $23.80 compared to its price of $23.20 on September 2, 2016. This translates to a potential return of 2.5%.

Knight Transportation

Knight Transportation (KNX) has a consensus rating of 3.1, or a “hold.” Of the 21 analysts who gave recommendations, two gave it a “buy,” and 17 gave it a “hold.” Two analysts gave it a “sell.” KNX’s average 12-month price target is $27.80 compared to its closing price of $28.30 on September 2, 2016.

Swift Transportation

Swift Transportation (SWFT) has a Wall Street analyst consensus rating of 4.2, or a “strong buy.” Of the 20 analysts covering the stock, 12 gave it a “buy,” seven gave it a “hold,” and one gave it a “sell.” The stock’s average 12-month price target is $21.30 compared to its market price of $18.90 on September 2, 2016. This implies a potential return of 12.2%.

JB Hunt Transport Services

JB Hunt Transport Services (JBHT) has a Wall Street analyst consensus rating of 4.1, or a “buy.” Of the 26 analysts covering the stock, 15 gave it a “buy,” and the rest gave it a “hold.” JBHT’s average 12-month price target is $90.30 compared to its price of $80.20 on September 2. This translates to an implied return of 12.5%.

Landstar System

Landstar System (LSTR) has a Wall Street analyst consensus rating of 2.9, or a “hold.” Of the 20 analysts tracking the stock, only one gave it a “buy,” 17 gave it a “hold,” and two gave it a “sell.” LSTR’s average 12-month price target is $67.90 compared to its market price of $69.80 on September 2, 2016.

Major US airlines (DAL) and railroads are included in the portfolio holdings of the iShares Global Industrials (EXI). This ETF holds 1.1% and 2.1%, respectively, in global express delivery companies FedEx (FDX) and United Parcel Service (UPS).

In the next and final part of our comparative trucking carriers series, we’ll take a look at the valuations for these companies.