Is Coca-Cola’s Segmented Revenue Approach Working?

Coca-Cola has a dominant position in the US market. However, US soda volumes have been declining for more than a decade.

Sept. 14 2016, Updated 8:05 a.m. ET

Segmented revenue approach

Coca-Cola (KO) is following a segmented revenue approach that differs across its geographic regions. For instance, in developed markets like North America, the company is focusing on driving its revenue through higher pricing.

Coca-Cola has a dominant position in the US market. However, US soda volumes have been declining for more than a decade.

The company is trying to mitigate the impact of weak soda volumes through a strategy based on price realization. Rivals PepsiCo (PEP) and Dr Pepper Snapple (DPS) are also depending on higher pricing to improve their top lines in domestic markets.

Strategy for developing and emerging markets

For developing markets, Coca-Cola is following a balanced strategy based on volume and pricing. In emerging markets such as India and Indonesia, the company is focusing on a volume-led strategy. This is because the priority of the company in the emerging markets is to establish its distribution network, create more visibility, and enhance the scale of its operations.

The iShares Global Consumer Staples ETF (KXI) and the Vanguard Dividend Appreciation ETF (VIG) have 4.7% and 3.6% exposure, respectively, to Coca-Cola.

Is the strategy working?

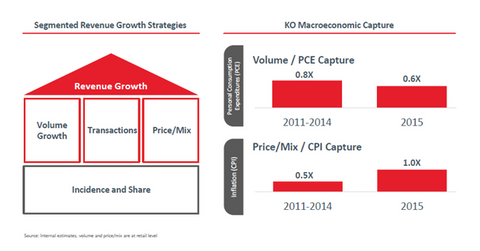

In the Barclays Global Consumer Staples Conference held on September 6, James Quincey, Coca-Cola’s president and chief operating officer, explained how the company’s segmented revenue approach is helping it to achieve better results.

Quincey noted that in the 2011–2014 period, the company was able to capture only 50% of the inflation in its pricing. However, Coca-Cola’s segmented revenue approach enabled the company to capture 100% of inflation in 2015.

The company is also trying to enhance its margins through a favorable mix. Coca-Cola (KO) is promoting smaller packages of its soda beverages. These smaller packages carry a higher price per ounce. Aside from targeting higher margins from these smaller packages, the company is also promoting them as healthier options compared to a larger quantity of soda beverages.

We’ll discuss Coca-Cola’s focus on still beverages in the next part of this series.