Why Caution Holds the Key

The UK has taken over other countries as the most sought-after bond market destination, especially after the Brexit vote.

Sept. 8 2016, Updated 1:54 p.m. ET

Managing risk is key

Investment popularity does not tell us much about the direction of returns over the long run (i.e. the next 12 months). In fact, we expect that many of today’s consensus trades could be long-term winners as low economic growth and low interest rates persist.

Yet some popular positions are approaching extreme levels (scores above 2 or below -2), which we see as an important signal of short-term risk. These positions may be vulnerable to a market shock or rising volatility, especially when combined with high valuations. It’s crucial to manage this risk by being selective.

Market Realist – Some popular investment positions are approaching extreme levels

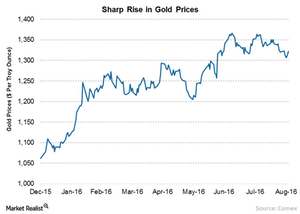

Historical investment patterns demonstrate that investors often follow investment strategies that are more popular during certain times. Such patterns may not always yield the desired results in the long term. Hence, investors may need to exercise extreme caution.

However, given the prevalent economic and low interest rate scenario, we believe that the select popular investments discussed in the previous article are likely to yield competitive returns in the long run.

Central banks are biggest buyers of bonds

Nevertheless, some popular investments may have run their course and are trading at riskier levels. Government bonds (IAGG) (GOVT) around the world have witnessed robust demand, especially after the Brexit vote.

According to J.P. Morgan, the central and commercial banks (IXG) around the world currently hold bonds worth nearly $27 trillion. This is almost 50% of the global bond universe, as represented by the Barclays Multiverse Global Bond Index.

Additionally, they hold around 67% of the government bond subset. The data further showed that cumulative bond (AGG) (SHY) buying by the Federal Reserve, European Central Bank, Bank of Japan, and Bank of England since the financial crisis of 2008 amounted to more than $8.6 trillion this year.

Rally in UK government bonds

The UK has taken over other countries as the most sought-after bond market destination, especially after the Brexit vote. The UK government’s ten-year bond yield plunged to a record low of 0.52% in August 2016. Although it has retraced since then, they are still lower by 61.8% during the last year.

Such a huge rally in UK government bonds creates distortion in the market. Hence, investors need to be cautious in the short term because of the expected rise in volatility.