Ingredion’s Top and Bottom Lines Rose in 2Q16

Ingredion’s (INGR) stock price rose by 0.35% to close at $133.24 per share during the fourth week of July 2016.

Aug. 1 2016, Published 3:52 p.m. ET

Price movement

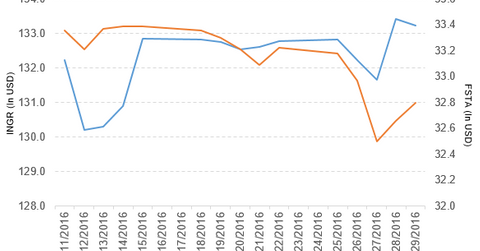

Ingredion’s (INGR) stock price rose by 0.35% to close at $133.24 per share during the fourth week of July 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.35%, 7.7%, and 40.1%, respectively, as of July 29. INGR is trading 1.1% above its 20-day moving average, 6.6% above its 50-day moving average, and 25.5% above its 200-day moving average.

Related ETFs and peers

The Fidelity MSCI Consumer Staples ETF (FSTA) invests 0.38% of its holdings in Ingredion. The ETF tracks a market-cap-weighted index of stocks in the US consumer staples sector. The YTD price movement of FSTA was 9.0% on July 29.

The SPDR S&P 400 Mid-Cap Growth ETF (MDYG) invests 0.59% of its holdings in Ingredion. The ETF tracks a market-cap-weighted index of growth companies culled from the S&P 400.

The market caps of Ingredion’s competitors are as follows:

Performance of Ingredion in 2Q16

Ingredion reported 2Q16 net sales of $1.46 billion, a rise of 0.44% over the net sales of $1.45 billion in 2Q15. Sales of the North America and EMEA (Europe, the Middle East, and Africa) regions rose by 3.0% and 1.7%, respectively, and sales of the South America and Asia Pacific regions fell by 4.0% and 6.1%, respectively, between 2Q15 and 2Q16. The company’s gross profit margin and operating income rose by 10.8% and 14.6%, respectively. It reported a restructuring charge of $13.0 million in 2Q16.

Its net income and EPS (earnings per share) rose to $117.2 million and $1.58, respectively, in 2Q16, compared with $106.7 million and $1.47, respectively, in 2Q15. It reported adjusted EPS of $1.73 in 2Q16, a rise of 13.1% from 2Q15.

INGR’s cash and cash equivalents and inventories rose by 12.2% and 6.7%, respectively, between 4Q15 and 2Q16. Its current ratio rose to 3.1x and its debt-to-equity ratio fell to 1.2x in 2Q16, compared with 2.6x and 1.3x, respectively, in 4Q15.

Projections

The company has made the following projections for fiscal 2016:

- adjusted EPS in the range of $6.70 to $6.90, which excludes acquisition-related and integration costs and impairment and restructuring costs

- effective tax rate of ~30%–32%

- cash generated by operations in the range of $725 million to $775 million

- capital expenditures of $300 million

In the next part, we’ll discuss International Paper.