Fidelity MSCI Consumer Staples Index ETF

Latest Fidelity MSCI Consumer Staples Index ETF News and Updates

Why Ingredion Acquired Sun Flour’s Rice Starch and Rice Flour Business

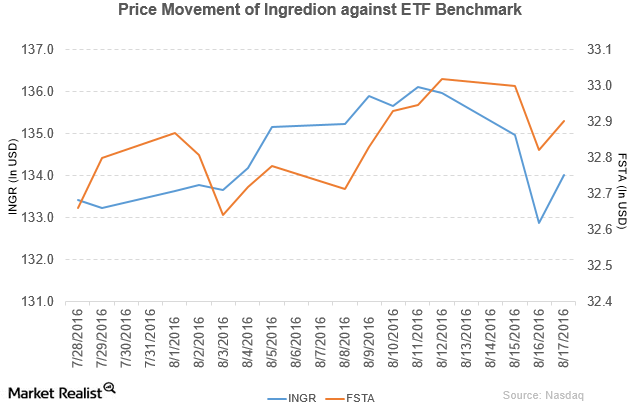

Ingredion (INGR) has a market cap of $9.7 billion. It rose by 0.87% to close at $134.02 per share on August 17, 2016.

Ingredion’s Top and Bottom Lines Rose in 2Q16

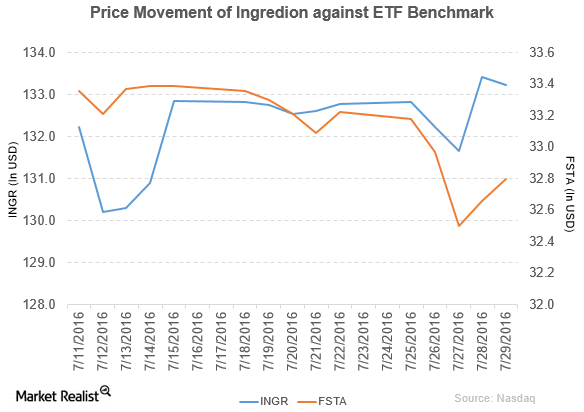

Ingredion’s (INGR) stock price rose by 0.35% to close at $133.24 per share during the fourth week of July 2016.

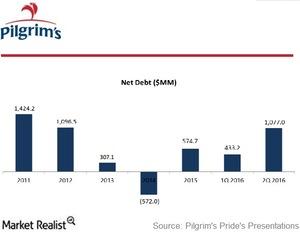

How Has Pilgrim’s Pride Made Room for Strategic Investments?

Consistent with its strategy to improve capital structure and generate shareholder value, Pilgrim’s Pride (PPC) paid $700 million, or $2.75 per share, in special dividends.

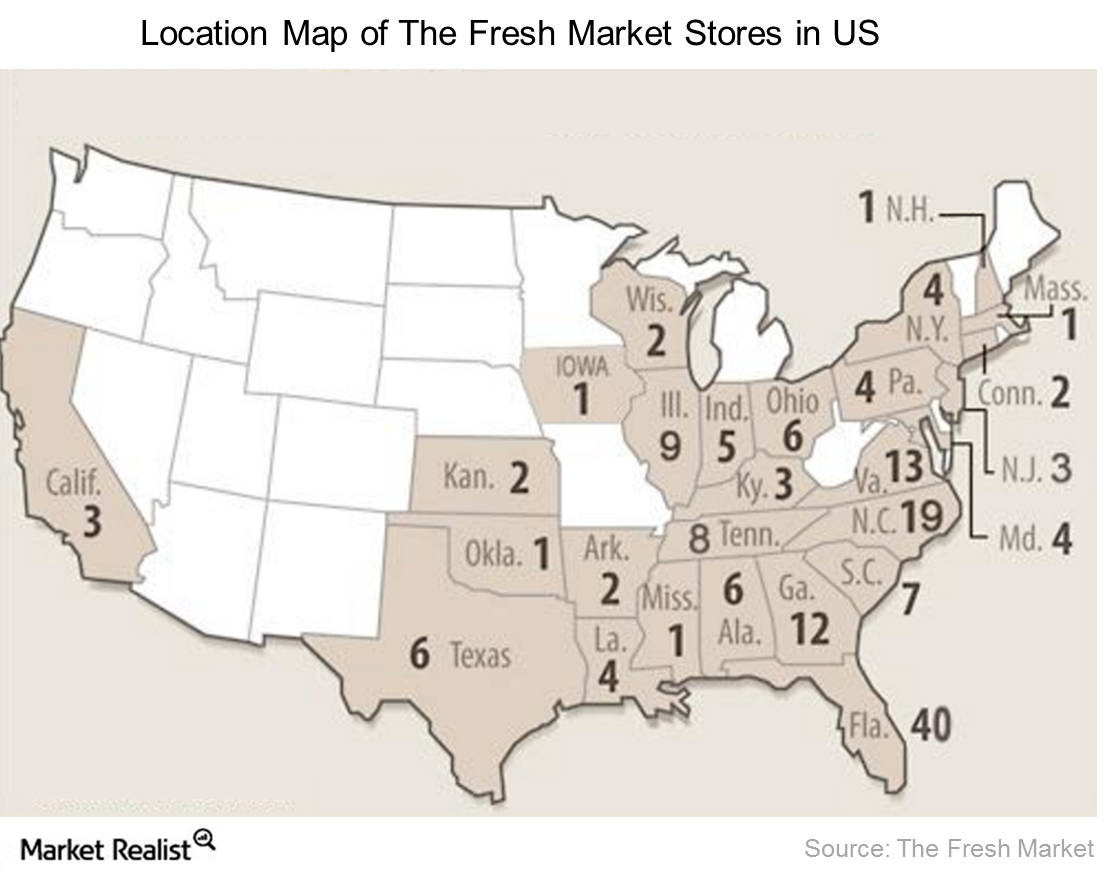

Where Is The Fresh Market Based and Where Is It Expanding?

The Fresh Market believes that it can achieve better returns by expanding in markets within or closer to its existing markets.

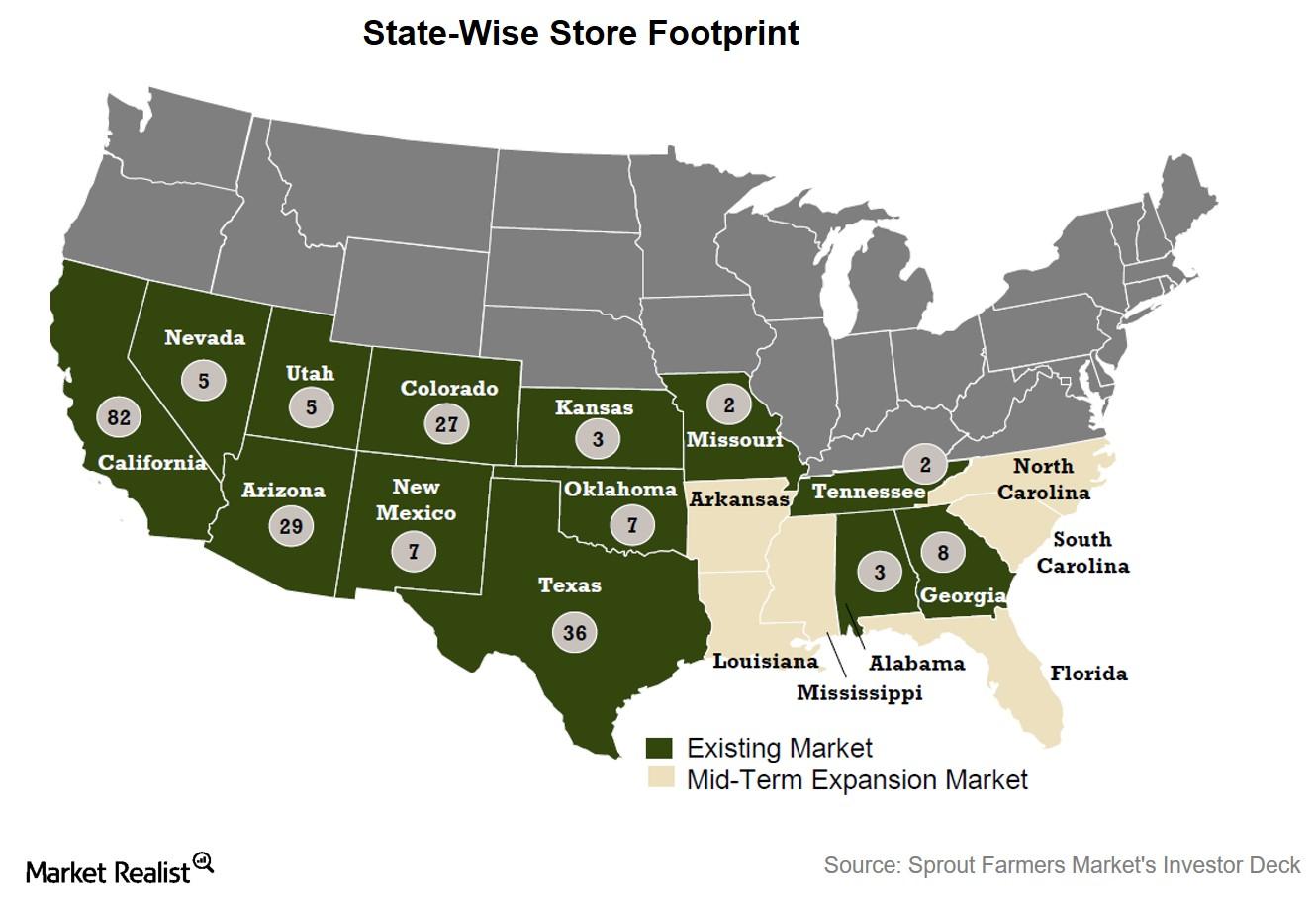

A Closer Look at Sprouts Farmers Market’s Business Strategies

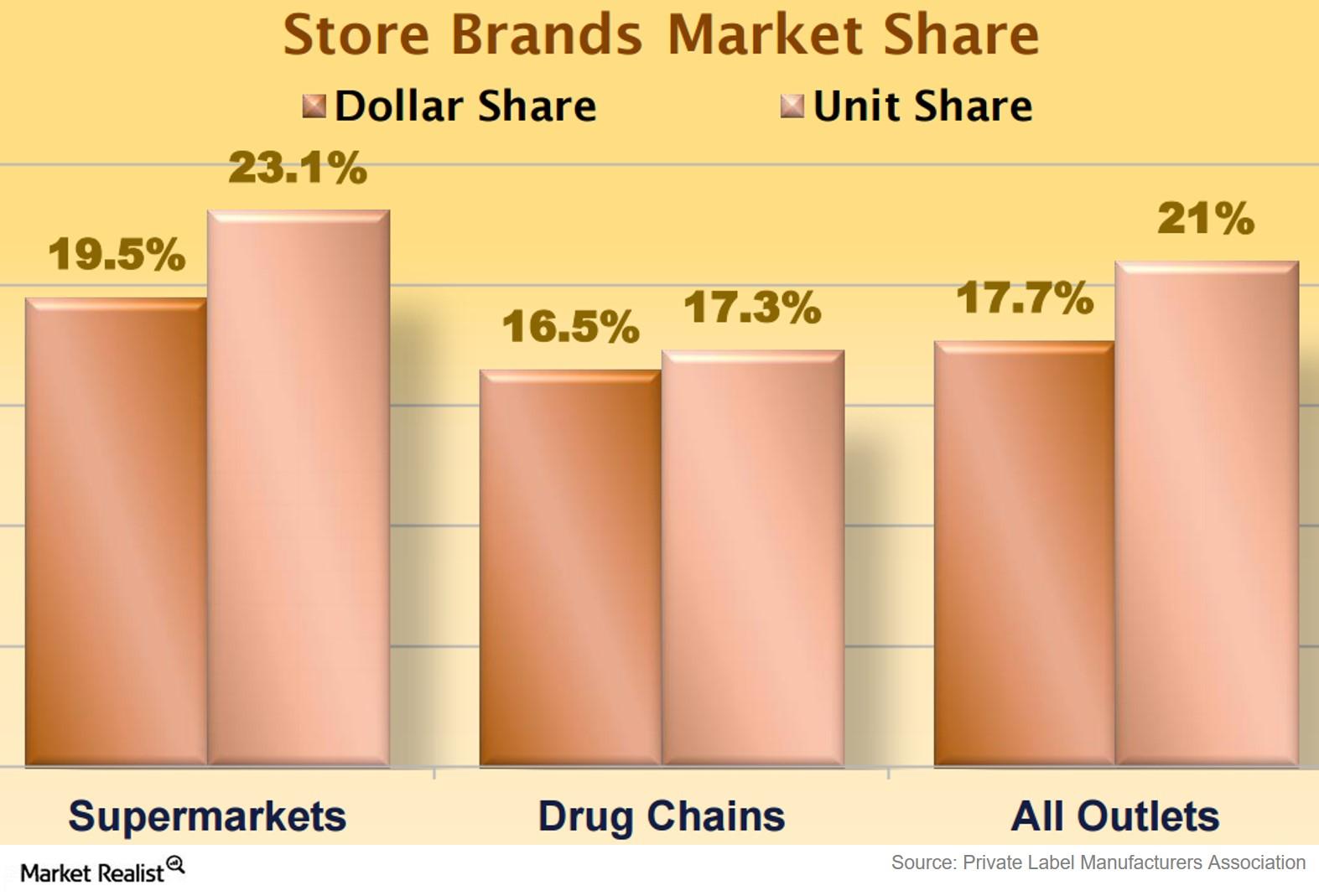

Sprouts has been expanding its private label menu by introducing new and innovative products. As of 3Q15, it offered more than 1,700 private-label items.

A Key Business Overview of Sprouts Farmers Market

Sprouts is a value player in the organic grocery sector, selling groceries at competitive prices from small-box stores averaging 28,000–30,000 square feet.