Should Minimum Volatility Be Part of Your Core Holdings?

The minimum volatility strategy has worked very well in the last ten years. It also tends to be a less risky strategy.

July 18 2016, Published 9:12 a.m. ET

But predicting such turns is very hard and most investors struggle to get both decisions right — that is, when to get out, and when to get back in. According to Bloomberg data, many investors sold near the bottom on June 27, and missed the rebound — which is exactly what minimum volatility strategies are designed to help investors avoid. These strategies are intended as long-term strategies as their full potential benefits tend to be realized over a full market cycle.

Min vol strategies as core holdings

Because of their potential longer-term benefits, it’s worth considering minimum volatility funds as core holdings. The underlying indexes for the iShares minimum volatility ETFs have constraints on sector and country exposures relative to the parent indexes, so their diversification aims to approximate that of the broad market index. Consider: iShares Edge MSCI Min Vol USA ETF (USMV), iShares Edge MSCI Min Vol EAFE ETF (EFAV) and iShares Edge MSCI Min Vol Emerging Markets ETF (EEMV).

And more importantly, history has shown that market-moving events like Brexit are as inevitable as they are unpredictable. Reducing risk with minimum volatility strategies and having them as the core part of a portfolio could make sense.

Market Realist – Minimum volatility should be part of your core holdings.

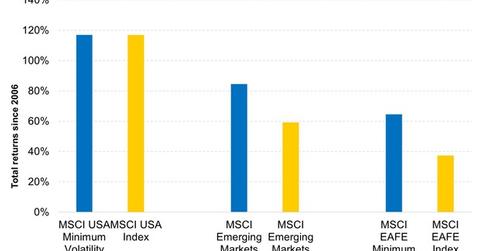

The above graph compares the returns of minimum volatility indexes with regular indexes. The MSCI USA Minimum Volatility index and the MSCI USA index (EUSA) both have risen 116.9% since the start of 2006.

The MSCI Emerging Market Minimum Volatility index has risen 84.4% compared to a 59.2% rise in the iShares MSCI Emerging Markets index (EEM). The MSCI EAFE Minimum Volatility index has risen 64.5% since 2006, while the MSCI EAFE index (EFA) has only risen 37.3% in that period.

As you can see, the minimum volatility strategy has worked very well in the last ten years. It also tends to be a less risky strategy.

With the Markets likely to remain volatile with slowing global growth and a number of other uncertainties, the minimum volatility strategy appears to be a prudent one.