What Does the Correlation between Water Utilities and Crude Oil Mean?

Investors may find water utilities attractive due to their yields and stable earnings growth. However, they may not be as safe as they seem.

July 12 2016, Updated 8:05 p.m. ET

Correlation between crude oil and water utilities

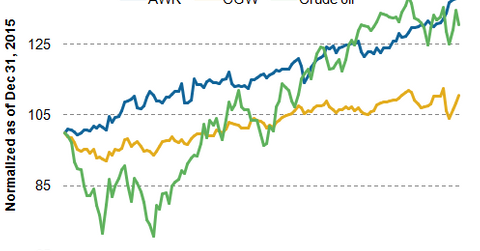

Investors may find water utilities attractive due to their yields and stable earnings growth. However, they may not be as safe as they seem. The correlation coefficient between crude oil and the Guggenheim S&P Water Index ETF (CGW) in 2016 is 0.5. In comparison, the correlation between AWK and crude oil during the same period was -0.01. CGW invests in water utilities and industrials. Almost 50% of its holdings are in the industrial sector, which makes it vulnerable to crude oil.

The chart above shows the comparative price movement of American Water Works and the Guggenheim S&P Water Index ETF (CGW) against crude oil.

Water utilities and water ETFs

Investments in water utility holding companies may offer a relatively better risk-reward proposition for investors given their stable growth and fair yields. However, water utility ETFs such as CGW may not be the best option for investors who want exposure to water utilities, as they tend to have a high correlation with crude oil. CGW holds 50% of its holdings in the industrials sector, which makes it susceptible to crude oil prices.

The Guggenheim S&P Water Index ETF (CGW), the PowerShares Water Resources Portfolio (PHO), the PowerShares Water Resources Portfolio (PIO), and the First Trust ISE Water Index ETF (FIW) invest a substantial portion of their holdings in the industrial sector.

Water utility ETFs yield roughly 100–150 basis points more than what water utility holding companies yield. A major part of the incremental yields that water ETFs obtain likely comes from their investments in the industrial sector. However, at the same time, these funds are exposed to oil price volatility, which can make them an unattractive investment option for conservative investors.