How Did Cal-Maine Foods Stock React to Its Fiscal 4Q16 Results?

Cal-Maine Foods reported its fiscal 4Q16 results on July 18. There wasn’t impact on the stock price even though the company reported a loss for the quarter.

July 25 2016, Updated 11:04 a.m. ET

Stock reacts to results

Cal-Maine Foods (CALM) reported its fiscal 4Q16 results on July 18. There wasn’t impact on the stock price even though the company reported a loss for the quarter. It closed 0.07% higher at $44.18 on the same day.

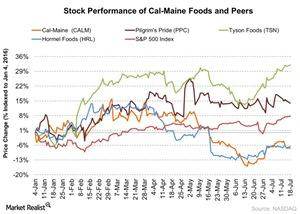

The company has been seeing declining growth in its shares in the last three months. Analysts’ drastic revisions for earnings estimates, led by falling egg prices along with the stock’s recent downgrade by DA Davidson, impacted the stock. On May 9, the firm downgraded the stock to “underperform.” The firm also lowered the stock’s target price to $37 due to lower egg prices. The stock fell 5% on the day. Since then, it has dropped 10%. The stock closed at $44.18 on July 18. So far in 2016, the stock fell 7%.

The stock started gaining in 2015 after being impacted by the outbreak of avian influenza. It rose as much as 20% in 2015.

Management’s comments on the results

Dolph Baker is the chairman, president, and CEO of Cal-Maine Foods. He stated that “Throughout this fiscal year, our industry continued to deal with the aftermath of the Avian Influenza (AI) outbreaks that occurred in the spring of 2015. While there have been no positive tests for AI at any of our locations, the outbreak significantly affected egg supplies and prices. Our results for the fourth quarter reflect these extremely volatile egg market conditions and supply disruptions.”

Peers’ stock performance

Cal-Maine Foods’ is the largest producer and marketer of shell eggs in the US. Its privately held peers include Rose Acre Farms, Michael Foods, and Moark. Hormel Foods (HRL), another peer in the food and meat industry, has fallen 6% so far in 2016. Pilgrim’s Pride (PPC) and Tyson Foods (TSN) have gained 14% and 32%, respectively.

The share price of the PowerShares Dynamic Food & Beverage ETF (PBJ) increased 7% during the same period. PBJ invested 59% of its holdings in food and beverage companies. The iShares Morningstar Small Value ETF (JKL) and the SPDR Dow Jones Small Cap Growth ETF (SLYG) invest 0.28% and 0.43% in Cal-Maine.