SPDR® S&P 600 Small Cap Growth ETF

Latest SPDR® S&P 600 Small Cap Growth ETF News and Updates

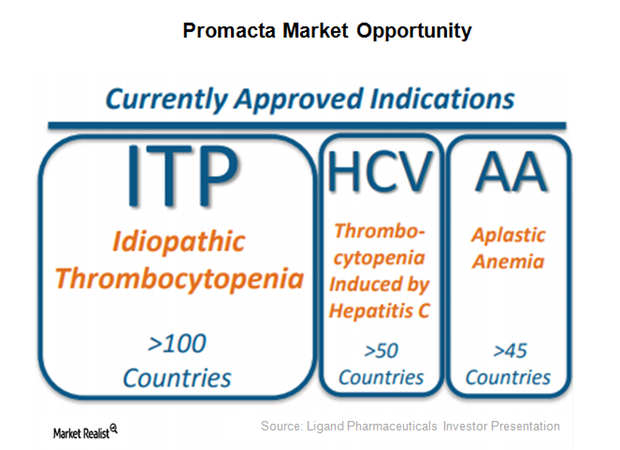

Promacta: A Major Growth Driver for Ligand Pharmaceuticals in 2017

Promacta was discovered by Ligand Pharmaceuticals (LGND) and GlaxoSmithKline (GSK) as a part of their thrombopoietin (or TPO) receptor agonist research collaboration.

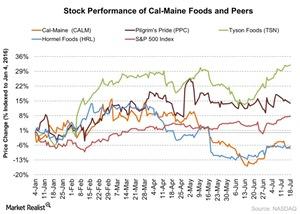

How Did Cal-Maine Foods Stock React to Its Fiscal 4Q16 Results?

Cal-Maine Foods reported its fiscal 4Q16 results on July 18. There wasn’t impact on the stock price even though the company reported a loss for the quarter.

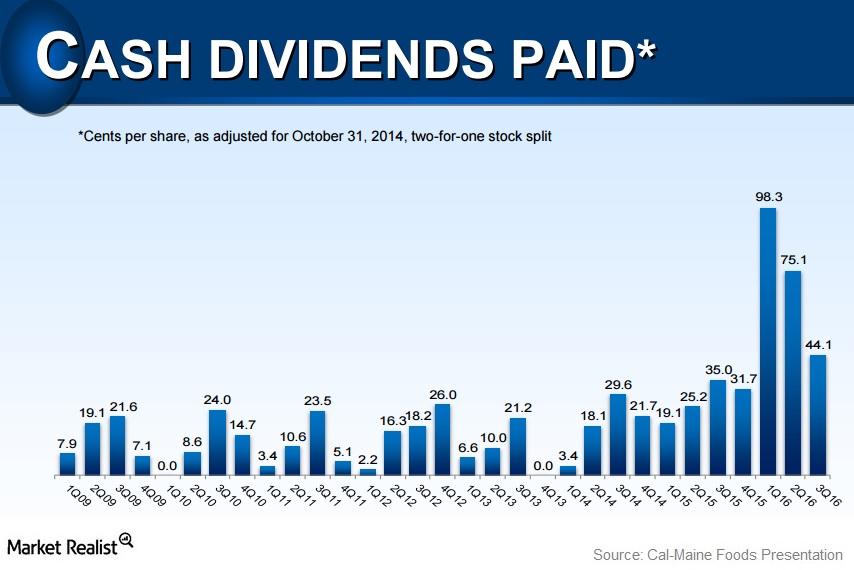

How Much Did Cal-Maine Return to Shareholders in Fiscal 2016?

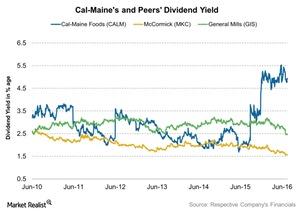

Cal-Maine Foods has a dividend yield of 4.0% as of July 18, 2016. Management raised the dividend at a CAGR (compound annual growth rate) of 15.3% over five years.

Analyzing Cal-Maine Foods’ Variable Dividend Policy

Cal-Maine has a variable dividend policy in place. It has a dividend yield of 5.8% as of June 28. Management raised the dividend at a CAGR of 15.3% over five years.

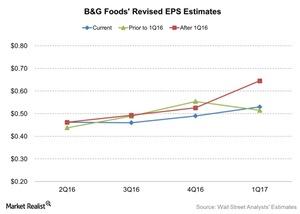

Analysts Have Revised EPS Estimates for B&G Foods: Why?

B&G Foods’ (BGS) earnings estimates have been on an upward trend since its fiscal 1Q16 impressive results. The Green Giant acquisition contributed to the results.