BOE Monetary Policy Will Be the Highlight This Week

The BOE is scheduled to release it monetary policy on July 14—the first after the United Kingdom decided to leave the European Union in a historic referendum.

July 11 2016, Published 8:27 a.m. ET

BOE expected to take a dovish stance

The BOE (Bank of England) is scheduled to release its monetary policy on July 14—the first after the United Kingdom (EWU) decided to leave the European Union in a historic referendum on June 23, 2016. The BOE has always thought that a Brexit would be hard for the United Kingdom’s economy (FKU). It’s safe to assume that there will be a more expansionary monetary policy. Markets are expecting a rate cut by the BOE with bets on for an increase in the asset purchase program to provide more liquidity in the system.

Another hectic week

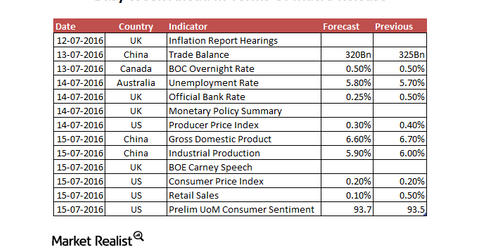

With the Federal Open Market Committee showing signs of bouncing back, markets will be looking forward to this week’s releases to get more insights into the Fed’s thinking ahead of the monetary policy. The Producer Price Index will be the first major data this week. It’s expected to release at 0.3% on July 14. The last day of the week has three major releases—the CPI (consumer price index), retail sales, and the University of Michigan consumer sentiments. The CPI is expected to rise by 0.20%, while the market expects retail sales to rise by 0.10%. The US Dollar Index (UUP) is expected to rise if the data meet the forecasts.

Asian data release and Canadian monetary policy

The Bank of Canada is scheduled to come out with a dovish stance in the monetary policy release scheduled for July 13, 2016. The Bank of Canada’s dovish stance forecasts rose after the Canadian employment figures fell below forecasts in terms of employment change and the unemployment rate. Among Asian data releases, we have the Australian (EWA) unemployment rate on July 14. The Chinese (FXI) (MCHI) data release this week—including trade balance, industrial production, and the GDP—are also expected to have a major impact on the global markets.