How Much Could Brexit and Volatility Control Gold?

Fears in the overall financial market about a Brexit, the possible exit of Britain from the European Union, have abated. This helped gold fall.

Dec. 4 2020, Updated 10:53 a.m. ET

Markets versus gold

On Tuesday, June 21, 2016, gold touched its lowest level for the last ten days. The RSI (relative strength index) level for gold fell to 50. Fears in the overall financial market about a possible Brexit (exit of Britain from the European Union) have abated. This helped gold fall.

Many other upcoming events may likely influence the price of gold. The German and Eurozone sentiment, the Japanese and US PMI (Purchasing Managers’ Index) figures, and US consumer sentiment could also have an impact on gold.

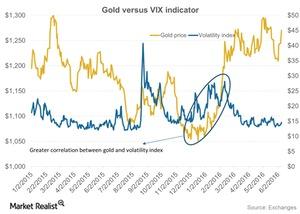

Gold is often seen rising when the scenario in the financial markets becomes troublesome and investors enter a risk-on mode. The overall volatility of the markets can be predicted by the Volatility Index (or VIX) indicator. Gold often closely follows the trend in volatility.

FOMC and Brexit

If Britain votes not to exit the European Union tomorrow, June 23, the FOMC (Federal Open Market Committee) may fast-pace their interest rate increase plan. Britain staying in the European Union would suggest a stabilizing financial market. If that’s the case, gold could fall due to a greater fear of a sooner than otherwise expected rate hike.

According to data from the Swiss customs bureau, the United Kingdom was the leading destination for Swiss gold exports in May for the third straight month. Investments in bullion-backed funds based in Britain continued to surge.

The fall in gold on Tuesday also brought about a decline in mining-based shares such as Barrick Gold (ABX), Goldcorp (GG), and Newmont Mining (NEM). They fell 3%, 1.4%, and 1.4%, respectively, that day.

Leveraged mining funds that fell on Tuesday include the Direxion Daily Gold Miners Bull 3X ETF (NUGT) and the ProShares Ultra Silver (AGQ). These two funds fell 8.4% and 3%, respectively, that day.

Next, let’s take a look at Janet Yellen’s cautious approach to a rate hike and how it could affect gold.