Coca-Cola Expands Its Still Portfolio with a Stake in Aloe Gloe

Coca-Cola’s Venturing & Emerging Brands unit has acquired a minority stake in the certified organic, non-GMO, and gluten-free drink Aloe Gloe.

June 24 2016, Published 1:26 p.m. ET

Stake in Aloe Gloe

Soda giant Coca-Cola (KO) has purchased a minority stake in Aloe Gloe, an aloe water beverage. As disclosed on June 22, 2016, the Venturing & Emerging Brands unit of Coca-Cola acquired a minority stake in the certified organic, non-GMO (genetically modified organism), and gluten-free drink.

Coca-Cola’s Venturing & Emerging Brands unit identifies and develops brands that have huge growth potential. The unit has previously added brands such as Honest Tea, Zico coconut water, and Suja juices to Coca-Cola’s portfolio.

More about Aloe Gloe

Aloe Gloe is part of L.A. Libations, an entrepreneurial beverage company founded by Danny Stepper, Pat Bolden, and Dino Sarti. The company focuses on providing health and wellness beverages.

Aloe Gloe was introduced in 2012 and is now available in 20,000 stores nationwide, including Sprouts Farmers Market (SFM), Kroger (KR), Safeway (SWY), and many independent grocers and convenience stores. Currently, Aloe Gloe is available in four flavors: Crisp Aloe, Coconut, Lemonade, and White Grape.

L.A. Aloe sells Aloe Gloe in the United States and Canada directly and through its strategic direct-store-delivery partner Coca-Cola Refreshments. The new deal will help Aloe Gloe to reach more consumers by leveraging Coca-Cola’s extensive distribution network.

Rationale behind the acquisition

Coca-Cola’s minority stake in Aloe Gloe will help the company to capture the growing demand for plant-based beverages. Coca-Cola accounts for 9.2% of the Consumer Staples Select Sector SPDR ETF (XLP) and 5% of the iShares Global Consumer Staples ETF (KXI).

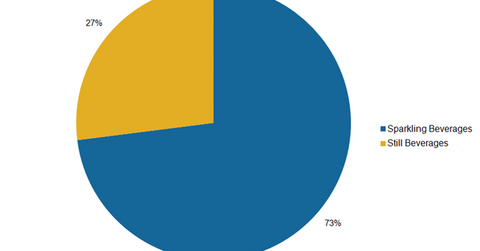

The acquisition will also help Coca-Cola to expand its still beverage portfolio and reduce its exposure to soda beverages. Coca-Cola’s carbonated soft drinks, also called sparkling beverages, accounted for 73% of its worldwide unit case volume in 2015. Still beverages accounted for the remaining 27%.

PepsiCo (PEP) has also been reducing its exposure to soda beverages as more and more consumers are preferring healthier options. As mentioned in PepsiCo’s 1Q16 conference call, 12% of the company’s global revenue comes from sales of its trademark Pepsi, and less than 25% comes from carbonated soft drink sales. About 80% of Dr Pepper Snapple’s (DPS) sales are in the soda category.

We’ll discuss Coca-Cola’s focus on still beverages in the next part of this series.