High Yield Bond Issuance Hit 2016 Record Last Week

High yield bond issuance surged last week and hit its highest level in 2016 yet due to continued growth in volume.

Nov. 20 2020, Updated 5:06 p.m. ET

Deals and flows analysis in the high yield bond markets

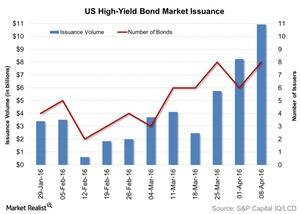

High yield bond issuance surged last week and hit its highest level in 2016 yet due to continued growth in volume. According to data from S&P Capital IQ/LCD, dollar-denominated high yield debt amounting to $10.9 billion was issued in the week ended April 8. Last week’s issuance was not only the highest year-to-date but also the largest since March 20, 2015. In the previous week, high yield issuance stood at $8.2 billion. The number of transactions rose to eight last week from six in the previous week.

Last week brought the total US dollar-denominated issuance of high yield debt to $49.0 billion in 2016 year-to-date (or YTD). This is lower by 54% compared to the corresponding period of 2015.

High yield debt is tracked by mutual funds like the Prudential Short Duration High Yield Income Fund-Class A (HYSAX) and the TIAA-CREF High-Yield Fund–Retail Class (TIYRX) and ETFs like the SPDR Barclays Capital High Yield Bond ETF (JNK) and the iShares iBoxx $ High Yield Corporate Bond Fund (HYG).

Purpose of the deals

Eight deals were priced last week including three for refinancing, two for general corporate purposes, two for spin-offs, and one for acquisition purposes.

Charter Communications (CHTR), Numericable SFR, and Sunoco LP (SUN) issued dollar-denominated junk bonds for refinancing purposes. Ally Financial and Springleaf Finance, an indirect wholly owned subsidiary of OneMain Holdings (OMH), issued dollar-denominated junk bonds for general corporate purposes.

MGM Growth Properties and Quorum Health issued dollar-denominated junk bonds for its spin-off from MGM Resorts International (MGM) and Community Health Systems (CYH), respectively. Meanwhile, Diebold Nixdorf issued dollar-denominated junk bonds for acquisition purposes. We’ll analyze deals priced last week and pricing trends in detail in the next article.