TIAA-CREF High Yield Fund

Latest TIAA-CREF High Yield Fund News and Updates

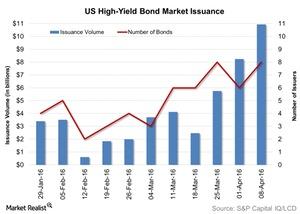

High Yield Bond Issuance Hit 2016 Record Last Week

High yield bond issuance surged last week and hit its highest level in 2016 yet due to continued growth in volume.

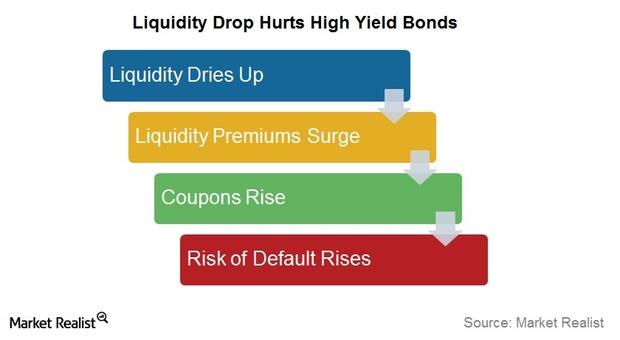

Investors in Junk Bond Mutual Funds Should Worry about Liquidity

If liquidity declines for junk bonds, the liquidity risk premium would rise. This would increase the coupon set on the bond. It will raise the borrowing cost for a company.