Spirit Airlines’ Valuation Ratio: How Does It Stack Up?

Spirit and its competitors have seen their EV/EBITDA decrease in the last six months due to the fear of a large increase in available seat miles.

Nov. 10 2015, Updated 6:06 p.m. ET

SAVE valuation

For airline companies, EV/EBITDAR (enterprise value to earnings before interest, tax, depreciation, amortization, and rent) is a better valuation metric than the P/E (price-to-earnings) ratio, mainly for two reasons.

- Airline companies generally have high debt levels. Price multiples don’t consider debt, while EV multiples do.

- Airline companies also have high leases, as aircraft can either be purchased or leased and multiples vary accordingly. EV/EBITDAR is used to compare companies with different lease and ownership structures.

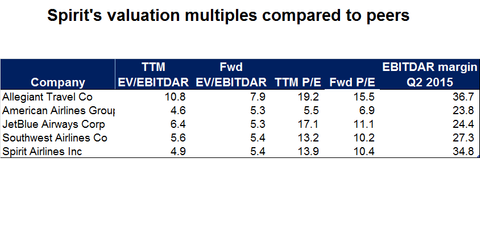

Spirit valuation multiple

Spirit’s (SAVE) EV/EBITDAR (trailing 12 month EBITDAR) for August 2015 is 4.9x, and it’s trading at a 23.9% discount to its peer average. The forward EV/EBITDA for the airline on October 30, 2015, was 28.8% lower than the median forward EV/EBITDA of its peers. Spirit had the lowest EV/EBITDA ratio, at 4.44x. Allegiant (ALGT) had the highest EV/EBITDA ratio, at 7.18x, followed by Southwest (LUV) at 5.74x, JetBlue (JBLU) at 5.72x, and American (AAL) at 4.71x.

Historical SAVE valuation multiple

Spirit had a forward EV/EBITDA multiple of 8.53x by fiscal 2014. Spirit’s EV/EBITDA ratio has increased in the last four years, from 3.98 for fiscal 2011 to fiscal 2014. For fiscal 2012, it was 4.56x, and it further increased to 9.76x for fiscal 2013. The company’s EV/EBITDAR ratio has increased from 8x for fiscal 2011 to 16.9x in fiscal 2014. In 2012, Spirit’s EV/EBITDAR decreased to 7.2x, and in 2013, it rapidly increased to 11.9x.

Spirit and its competitors have seen their EV/EBITDA decrease in the last six months due to the fear of a large increase in available seat miles. A fall in unit revenues for Spirit has driven its forward EV/EBITDA lower. However, note that EBITDA doesn’t account for rent and other leasing expenses that are normal in the airline industry. Companies that mostly lease their planes, such as Spirit and Allegiant, tend to show higher EV/EBITDA ratios than companies such as American that own the majority of their aircraft.

Investors can gain exposure to the airline industry through the iShares Dow Jones Transportation Average ETF (IYT), the U.S. Global Jets ETF (JETS), and the SPDR S&P Transportation ETF (XTN).