How Did Hain Celestial Perform in Fiscal 2Q16?

Hain Celestial Group’s (HAIN) fiscal 2Q16 had the strongest revenue performance in its history. The net sales for 2Q16 were $752.6 million.

May 2 2016, Updated 9:08 a.m. ET

Hain Celestial’s performance in 2Q16

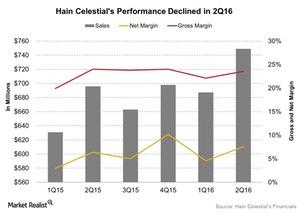

Hain Celestial Group’s (HAIN) fiscal 2Q16 had the strongest revenue performance in its history. The net sales for 2Q16 were $752.6 million—a rise of 8.1% YoY (year-over-year). The company showed strong sales growth in constant currency terms in some of its major brands including Plainville Farms, Tilda, Ella’s Kitchen, Sun-Pat, The Greek Gods, Alba Botanica, and Avalon Organics. The Empire, Kosher Valley, Joya, and Live Clean brands acquired after fiscal 2Q15 also contributed to the revenue growth. However, foreign exchange had an impact of $18.3 million on the revenue.

Earnings rose

The company has been on an overall positive earnings growth trend since fiscal 1Q11. The 2Q16 EPS (earnings per share) also increased 6% to $0.57—compared to $0.54 in 2Q15. However, there was a slight impact of $0.01 per diluted share from foreign currencies. The company also beat analysts’ estimates by 5.6% for fiscal 2Q16. The fiscal 2Q16 EPS were a little ahead of the guidance provided by the company.

Gross margin fell

Various factors were responsible for the decrease in the gross margin for 2Q16. The factors included the composition of the company’s US segment sales mix, increased investment in trade spending in the US to drive current and future consumption, the impact of Project Castle, and the cost of US dollar purchases in the company’s Canadian business.

Peers’ performance

Hain Celestial’s competitors in the industry include Cal-Maine Foods (CALM), Mead Johnson Nutrition Company (MJN), and Pinnacle Foods (PF). They recorded revenue of $450 million, $967 million, and $722 million, respectively, for their last reported quarters. The PowerShares DWA Consumer Staples Momentum Portfolio (PSL) invests 1.3% of its holdings in Pinnacle Foods.