Why UnitedHealth Group’s Net Profit Margins Fell

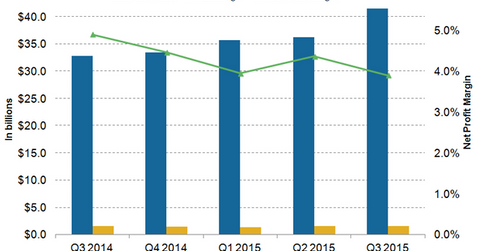

In 3Q15, despite a rise of total revenues by 27% year-over-year, which includes 10% organic growth, UnitedHealth Group reported a decline of about 1% in net profit margins.

Oct. 19 2015, Published 2:25 p.m. ET

Changing business mix

In 3Q15, despite a rise in total revenues by 27% year-over-year, which includes 10% organic growth, UnitedHealth Group reported a decline of about 1% in net profit margins. The company’s net profit margin was 3.8% in 3Q15, lower than 4.4% in 2Q15 and 4.9% in 3Q14.

The above graph shows the changes in UnitedHealth Group’s (UNH) quarterly revenues, earnings, and net profit margins from 3Q14 to 3Q15. Profit margin has witnessed a decline as the company has shifted its business mix towards pharmacy care services and individual exchange business, which generally yields lower margins during early-stage development. Other health insurance companies such as Aetna (AET), Cigna (CI), and Anthem (ANTM) are also actively pursuing opportunities in the individual exchange business.

Increased investments

UnitedHealth has been actively investing in improving the quality of its Medicare plans, which will eventually result in higher Medicare star ratings and higher payment rates. However, these investments have been a factor contributing to higher medical costs in 3Q15. The quality improvement will enable UnitedHealth Group to have 80% or more of its Medicare beneficiaries in plans rated four stars or more by 2018. Improvement in star quality ratings is expected to increase UnitedHealth Group’s Medicare reimbursement rates in 2016, 2017, and 2018. This will result in the company’s growth and strong financial position. For more information about Medicare star ratings, please refer to Why Medicare Advantage drives health insurance stocks.

Low reserve development

Compared to 3Q14 when UnitedHealth Group (UNH) recognized $270 million for reserve, the company recorded lower reserve development of $150 million in 3Q15. Reserves are created by health insurance companies to cover both anticipated and unanticipated healthcare costs. Lower reserve development helped UnitedHealth Group to slow down the decline in its net profit margins.

You can get exposure to UnitedHealth Group through the Health Care Select Sector SPDR ETF (XLV). UnitedHealth Group accounts for 4.59% of XLV’s total holdings.