Comp: Importance of Looking at Gold Miners’ Liquidity Profile

In a weaker commodity price environment, a company’s short-term liquidity might come under more pressure. It could be forced to take drastic measures.

Sept. 30 2015, Updated 3:07 p.m. ET

Liquidity position

As we saw in the last part, financial leverage is important to gauge the long-term solvency of a company. In addition, investors should take note of the short-term liquidity profile for these companies. In a weaker commodity price environment, the short-term liquidity for a company might come under more pressure. The company could be forced to take drastic measures.

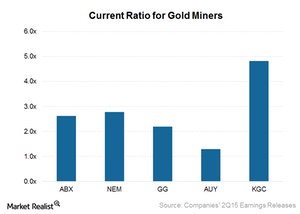

The current ratio is another way to estimate a company’s liquidity. The above graph shows gold miners’ current ratio. The current ratio indicates the ability of a company to pay its short-term obligations using its short-term assets.

The higher the ratio, the better the company is able to service its short-term liabilities and vice versa. Kinross Gold (KGC) and Newmont Mining (NEM) are doing the best on this parameter.

Net debt-to-EBITDA

Having a high debt isn’t always bad if a company has the capacity to pay it back with its earnings. The net-debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio tells how many years it will take for the company to repay its debt if the net debt and EBITDA stay constant. The net debt is calculated as the total debt minus cash and cash equivalents.

Barrick Gold (ABX)’s net debt-to-forward EBITDA ratio is 3.2x. This is higher than the ratio of its peers, as you can see in the above graph. Yamana Gold (AUY) and Goldcorp (GG) have net debt-to-forward EBITDA ratios of 2.7x and 1.5x, respectively.

Combined, Newmont Mining, Barrick Gold, and Goldcorp form 19.10% of the VanEck Vectors Gold Miners ETF (GDX). Investors can access the gold industry by investing in gold-backed ETFs like the SPDR Gold Trust (GLD).