Coal under Pressure as Natural Gas Prices Remain Subdued

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices fall, coal loses market share. It becomes more economical to use natural gas for power generation.

Nov. 4 2015, Updated 8:11 a.m. ET

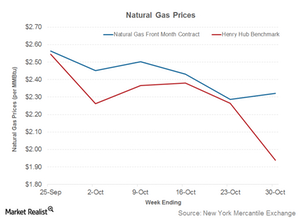

Natural gas prices

Henry Hub benchmark natural gas prices fell below $2 per MMBtu (British thermal units in millions) during the week ended October 30, 2015. The benchmark natural gas price came in at $1.94 per MMBtu on October 30 compared to $2.27 per MMBtu on October 23. Interestingly, natural gas futures prices rose during that week to $2.32 per MMBtu, from $2.29 per MMBtu as of October 23. The expected rise in winter demand lifted the futures prices.

Why are these indicators important?

The shale gas boom led to a massive rise in natural gas production. In turn, this spurred a fall in natural gas prices. As a result, natural gas is competing hard against coal. Cleaner and more competitive natural gas ate away the market share of coal in electricity generation, which is a continuing trend.

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices fall, coal loses market share. It becomes more economical to use natural gas for power generation. On the other hand, a rise in natural gas prices generally leads to a rise in coal’s market share.

Impact on coal and utilities

Subdued natural gas prices aren’t good news for coal producers (KOL) such as Alliance Resource Partners (ARLP) and Natural Resources Partners (NRP).

For utilities (XLU) such as Dynegy (DYN) and NRG Energy (NRG), the impact depends on the level of regulation. For regulated utilities, the impact is generally negligible because the fuel cost is part of the tariff calculations. For natural gas power plants supplying electricity at long-term fixed price contracts, subdued natural gas prices are a positive indicator.