Broad Commodities Market Sell-Off: Impact on Gold

The benchmark US ten-year note yield fell by eight basis points, or 0.08%, to 1.96% as of Monday, August 24. Recent buying ended a bearish period in gold.

Sept. 8 2015, Updated 2:21 p.m. ET

A risk-off trend

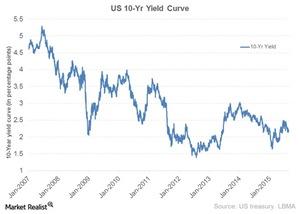

A general sell-off wave for commodities is prevalent in the current market. However, opting out of the risky assets means more money is flowing into the safe-haven investments like Treasuries, gold, and currencies like the yen and euro. US ten-year Treasury yield fell below the 2% mark for the first time in the past six years. Higher demand for the safe-haven Treasuries means higher prices and lower yields. It’s due to an inverse relationship between the bond prices and its yields. The benchmark US ten-year note yield fell by eight basis points, or 0.08%, to 1.96% as of Monday, August 24. Recent buying ended a bearish period in gold. It had fallen to a five-year low as recently as late July.

Oil slump adds to the fuel

As oil prices fell to a six-year low, due to the oversupply concerns, the effects were seen in precious metals as well. Lower crude oil prices accompanied with volatile Chinese markets may indicate an economic slowdown. China is the world’s second largest commodity consumer. The negative sentiment in the Chinese markets is adding fuel to lower commodity prices.

As of Monday, August 24, gold fell ~0.50% and touched a high of $1,169.80 per ounce. Silver fell 3.70% as of Monday, August 24. It was a remarkable day where global markets fell and most commodities fell due to oversupply concerns. Platinum and palladium fell 3.60% and 4.80%, respectively.

Precious metals are expected to face a tough time once the interest rates climb. However, the current tighter monetary policy gives precious metals some breathing room. Gold has no cash flows like interest or dividend bearing counterparts. This makes it even tougher to compete with the other asset classes in the absence of higher inflation rates.