Lower Commodity Prices Take a Toll on Freeport’s 2Q15 Profits

Freeport’s average realized copper prices fell 14% in 2Q15 on a year-over-year basis. Lower commodity prices took a toll on Freeport’s 2Q15 profits.

July 28 2015, Published 9:25 a.m. ET

Freeport’s 2Q15 profits

In the previous part of this series, we saw that Freeport-McMoRan (FCX) took a charge of $2 billion in 2Q15 due to the write-down of its energy assets. Even after adjusting for this charge, Freeport reported a dismal EPS (earnings per share) of $0.14. This is, however, an improvement over a loss of $0.06 per share that Freeport reported in 1Q15.

Lower commodity prices

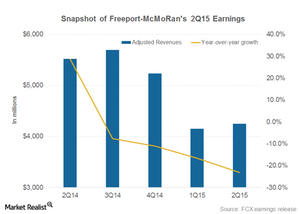

The above graph is a snapshot of Freeport’s 2Q15 financial results. As you can see, the company’s revenues fell 23% compared to the previous year. Falling revenues are largely attributable to a steep drop in commodity prices.

Freeport’s average realized copper prices fell 14% in 2Q15 on a year-over-year basis. The average realized prices in Freeport’s energy segment fell even more steeply due to the correction in crude oil prices. Lower commodity prices took a toll on Freeport’s 2Q15 profits.

Lower unit production cost

Unit cash production costs are a key metric for investors in the metals and mining space (XME). Freeport’s copper unit production costs declined to $1.50 per pound in 2Q15 compared to $1.72 last year. The drop in unit production costs was due largely to higher byproduct credits in Freeport’s Indonesian operations. Freeport mined a larger quantity of gold from its Grasberg mine in Indonesia.

Lower crude oil prices also helped Freeport bring down its unit production costs. According to estimates, energy prices account for ~18% of copper’s production cost. Lower crude prices would also bring down unit production costs for other copper producers, including Teck Resources (TCK) and Turquoise Hill Resources (TRQ). Teck Resources currently forms 0.30% of the iShares North American Natural Resources ETF (IGE).

In the next part, we’ll talk about the 2Q15 financial performance of Freeport’s energy business.