The Great American Deleveraging: Fact or Myth?

The great American deleveraging has largely been limited to the financial sector (XLF) (IYF). Non-financial debt is still much higher than historical averages.

May 4 2021, Updated 10:12 a.m. ET

3. There is already too much U.S. government debt.

Gross U.S. federal debt is at around 100% of GDP, a level historically associated with slower growth. And this gross debt doesn’t include unfunded liabilities related to the country’s pension and medical programs.

4. America has too much debt in general.

Tales of the great American deleveraging aren’t completely accurate. U.S. household balance sheets certainly are in much better shape than they were pre-crisis, and the financial sector is less levered. That said, overall non-financial debt in the United States has increased from $32 trillion on the eve of the financial crisis to more than $41 trillion today. Even after adjusting for the growth in the economy, the best you can say is that U.S. debt has stabilized. The ratio of non-financial debt-to-GDP is nearly 235%. While this is down a bit from the 2009 peak of 240%, debt is still disturbingly high from a historical perspective. The 60-year average is just 160% and even as recently as 10 years ago, non-financial debt was only 200% of GDP.

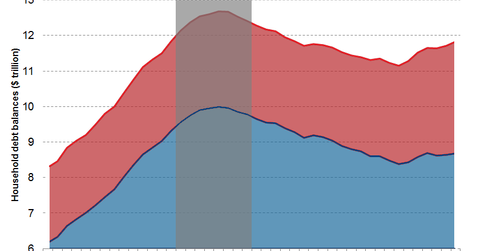

Market Realist – According to the Federal Reserve Bank of New York, the aggregate household debt balances stood at $11.83 trillion as of December 31, 2014, up 1%, or $117 billion, from 3Q14. Though overall household debt is still 6.7% lower than the levels seen in 3Q08, the debt level is higher than pre-recession levels. Debt for housing purposes (IYR) (VNQ) stands at $8.68 trillion, higher than the 1Q04 level of $6.17 trillion.

The great American deleveraging has largely been limited to the financial sector (XLF) (IYF). Non-financial debt is still much higher than historical averages. The previous graph shows the non-financial debt-to-GDP ratio. According to BlackRock estimates, non-financial debt has increased by a phenomenal $9 trillion during the period of “deleveraging.” Corporate debt (LQD) (AGG) too has been climbing steadily, buoyed by the near-zero interest rates prevalent in the economy. According to estimates from Morgan Stanley, net leverage for highly rated US non-financial companies (debt less cash as a multiple of annual earnings) was 1.88 times at the end of 2014, up from 1.63 times at the end of 2007.

US federal debt has increased by $7 trillion since President Barack Obama assumed office, and it currently stands at a massive $18 trillion. Read on to the next part of the series to understand the road ahead for the US economy.