Why Did the German 2s30s Spread Dip on Quantitative Easing?

The 2s30s spread is the difference between the yield on the 30-year bond (TLT) and the yield on the two-year bond (SHY).

Nov. 20 2020, Updated 2:36 p.m. ET

The surprises, if any, were to be found in Draghi’s Q&A session and in his more off-scripted moments. We consider two to be critical.

1. The maturity range of purchases.

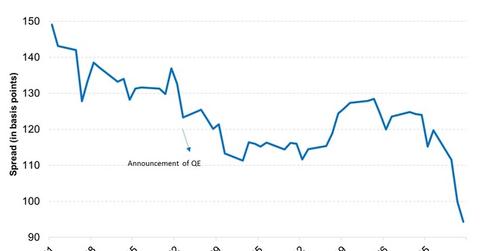

Having not been laid out in the prepared remarks, Draghi answered this question most casually. But as can be seen by the chart below, the casual extension of purchases out to 30 years appears not to have been the market expectation, as the clarification led to the most dramatic of market moves associated with the QE announcement.

This turnabout also appears to have turned overall yield sentiment. Whereas the initial reaction to the 60-billion-euros-a-month announcement of higher yields might have reflected some disappointment, Draghi’s clarification on maturity reversed that interpretation, leading to lower rates across the curve, the continent and spilling over into all global bond markets.

Market Realist – Why did the German 2s30s dip after the quantitative easing announcement?

The graph above shows the 2s30s spread for German bunds. The 2s30s spread is the difference between the yield on the 30-year bond (TLT) and the yield on the two-year bond (SHY). Thirty-year bonds tend to yield much higher than two-year bonds because investing in them entails much higher interest rate risk.

The announcement of the purchase of bonds with a maturity of 30 years seems to have taken the market by surprise. The aggressive buying of these bonds will lead to a dip in their yields, as there’s an artificial increase in the demand for these bonds. The market had already factored in the fact that quantitative easing would involve the purchase of two-year bonds. What it hadn’t factored in was the purchase of 30-year bonds. So, when Draghi mentioned this during the announcement, the 2s30s spread contracted.

US Treasury bond (IEF) yields also dipped during the quantitative easing that took place in the US (SPY)(VOO).