Economic essentials: The key interest rate and the prime rate

The key interest rate and the prime rate are central to the Canadian financial system. They key interest drives lending rates at the big banks.

Feb. 24 2015, Updated 10:05 a.m. ET

Understanding the key interest rate

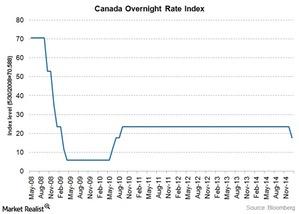

The key interest rate is the Bank of Canada’s target for the overnight rate. The Bank of Canada defines the overnight rate as the interest rate at which major financial institutions borrow and lend one-day, or overnight, funds among themselves. The bank sets a target level for that rate. This target for the overnight rate is often referred to as the bank’s key interest rate or key policy rate.

What makes the rate key is that the bank carries out its monetary policy by raising and lowering the target for the overnight rate to influence short-term interest rates. Changes in the rate influence the interest rates charged by commercial banks on corporate and consumer loans. For example, a rise in the key interest rate leads to a rise in the interest rates charged on consumer loans and mortgages, and vice versa. The impact on floating rate loans—mostly mortgages—is direct and immediate because these are often tied to the prime rate as benchmark, which is based on the key interest rate.

A change in the key interest rate can also affect the exchange rate of the Canadian dollar, as explained in Part 9 of this series.

The bank fixes eight dates each year on which it announces whether or not it will change the key policy rate. The “Big Six Banks” in Canada, including Royal Bank of Canada (RY), Bank of Montreal (BMO), Toronto-Dominion Bank (TD), Canadian Imperial Bank of Commerce (CM), Bank of Nova Scotia (BNS), and the National Bank of Canada, keenly await such announcements, as any change in the key interest rate affects their prime lending rate. The iShares MSCI Canada ETF (EWC) has allocated up to 32.83% of its portfolio to financial services institutions in Canada.

Understanding the prime rate

The prime rate is the lowest rate of interest at which money may be borrowed in an economy, commercially. It’s the lowest rate at which commercial banks make loans to consumers. Banks often use the key interest rate as a benchmark when setting the prime rate.

In Canada, home-equity lines of credit and variable-rate mortgages are tied to the prime rate, and they make up about 25% of the marketplace, according to the Canadian Association of Accredited Mortgage Professionals.

Spread between the key interest rate and the prime rate is widening

The prime rate usually tracks the Bank of Canada’s key interest rate. But, in Canada’s case, although the prime does considers the key interest rate, there is a spread, or differential, between the two, and it’s widening. What does this mean for the Canadian economy and your investments in it?