Where Are High Yield Bonds On The Risk Continuum?

High yield bonds (HYG), which are usually issued by mid- and small-cap companies, are considered riskier than investment grade corporate bonds.

Jan. 14 2015, Updated 2:56 p.m. ET

Despite the negative connotations, it’s important to remember that junk bonds are still bonds, and that means that they are generally less risky than equities (see below). This simple point is often misunderstood by many investors. High yield debt issuance has a higher claim on assets than equity issuance, which means that if a firm faces bankruptcy, the bond holders get paid before the equity investors. We’ve actually seen clients shifting their dividend-paying equity allocations into high yield for just this reason, as a way to reduce risk and boost income.

Market Realist – Where do high yield bonds sit on the risk continuum? The answer may surprise you

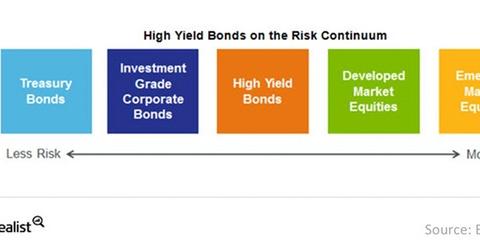

The chart above shows where high yield bonds sit on the risk continuum. Assets on the left-hand side are the safest. As we move to the right, assets get riskier.

As expected, Treasury bonds (TLT)(IEF) are the safest of the five. This is because the full faith and credit of the US government backs them.

Treasury bonds are followed by investment grade corporate bonds (LQD). Bonds issued by mega- and large-cap companies like Apple (AAPL), Microsoft (MSFT) et cetera fall under this category. These companies generate more than enough cash flow to service debt, which makes investment grade corporate bonds relatively safe.

Investment grade corporate bonds are followed by high yield bonds (HYG), which are usually issued by mid- and small-cap companies. As discussed earlier in this series, the higher probability of default drives yields higher. Under certain circumstances, you may not receive your coupon or principal, if credit markets are poor.

Meanwhile, equities are riskiest, but can provide the best returns. Equities are on top of the risk-return metric. Within equities, developed market equities (EFA) are safer. Emerging markets (EEM) are the riskiest due to factors like political instability, red tapism, and many more.

Within each equity market, defensive sectors are usually considered safer than cyclical sectors. The next part of the series focuses more on the risk-return metric.