Why tight credit spreads usually mean a period of global expansion

Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

May 4 2021, Updated 10:13 a.m. ET

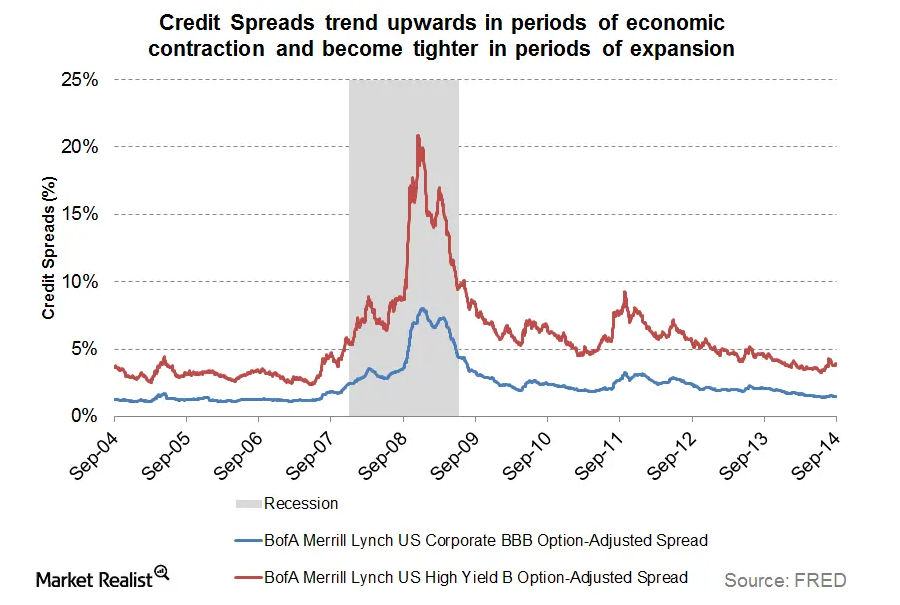

2. Credit spreads remain tight. Credit market conditions have historically been a good sign post for the global economy. Deteriorating credit conditions, measured by widening spreads, have generally been associated with slower growth, while tight spreads tend to coincide with faster growth. Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

Market Realist – The graph above shows how credit spreads tend to increase in recessionary periods. The Bank of America Merrill Lynch US Corporate BBB Option-Adjusted Spread index indicates the spreads between BBB rated corporate bonds (LQD) and U.S. Treasuries (TLT).

As the U.S. financial (XLF) crisis led the nation in to a recession from 2007 to 2009, credit spreads became very high. They started declining and tightening after the recession.

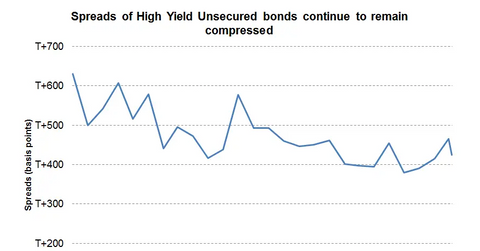

Market Realist – The graph above shows the BofA Merrill Lynch US Corporate BBB Option-Adjusted Spread and BofA Merrill Lynch US High Yield B Option-Adjusted Spread in the past year. Credit spreads have been falling—that is, tightening—in the past year for both investment-grade (AGG) and high yield bonds (JNK).

Market Realist – The graph above shows how the spreads between unsecured high yield bonds and U.S. Treasuries (IEF) remain compressed and are likely to remain so in the future. The only times spreads had been lower than now was in 2004 and 2006, when spreads had compressed to 300 basis points.

Read on to the next part of this series to see why stability in industrial metal prices reflects strength in the economy.