An Investor’s Guide To The Copper Industry

Mining giants Rio Tinto and BHP Billiton have diversified portfolios of iron ore, aluminum, and copper assets, with most revenues coming from iron ore.

Jan. 30 2015, Published 2:03 p.m. ET

Copper up close

The third most widely used metal in the world, copper is one of the earliest metals to be discovered by mankind. Iron ore is the most commonly used metal, followed by aluminum. However, iron ore does not has much usage on its own. Almost all of the mined iron ore goes into steel production.

Mining giants like Rio Tinto (RIO) and BHP Billiton (BHP) are diversified producers with portfolios of iron ore, aluminum, and copper assets. However, most of their revenues come from iron ore. Gold miners like Barrick Gold Corporation (ABX) also produce copper.

History of copper

Archaeological evidence suggests that copper was used at least 10,000 years ago to make coins and utensils. Copper found new applications after the industrial revolution, including construction, electrical components, and home fixtures. Copper also exists naturally in the human body, animals, and plants, and it is a crucial soil constituent.

Looking ahead

In this series, we will present a complete business overview of the copper industry, exploring the key points that investors in copper plays should understand. We will also look at the dynamics of major copper-producing and -consuming regions.

Copper prices have been quite volatile in the last few months. We will also analyze the outlook for the copper industry in the latter part of this series.

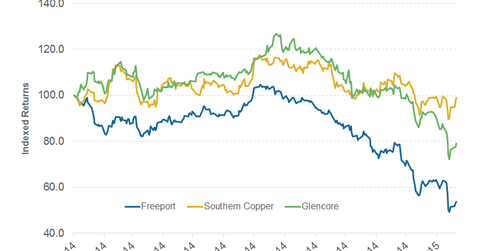

Freeport-McMoRan Copper & Gold (FCX), Glencore (GLNCY), and Southern Copper Corp. (SCCO) are the world’s major copper producers. FCX forms 3.63% of the SPDR S&P Metals and Mining ETF (XME), which invests in these companies. The previous chart shows the stock market performance of copper companies.

In the next section, we’ll look more closely at the copper industry.