Is the U.S. consumerism economy flawed by design?

The future liability of entitlements in the following decade of 2020–2030 presents an enormous financial challenge for the children and grandchildren of the baby boomer generation

Nov. 20 2020, Updated 11:20 a.m. ET

U.S. personal consumption

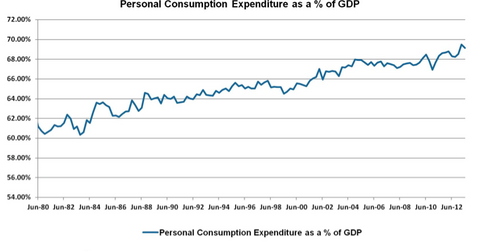

The below graph reflects the trend in U.S. personal consumption as a percent of gross domestic product since 1980. Personal consumption as a percent of the U.S. economy has continued to grow over time. However, economists question whether this trend can continue, and whether this level of consumption is healthy for sustaining long-term economic growth. In the short run, increased consumption in the United States can support the exports of developing economies, enhancing global growth prospects. However, in the long run, too much consumption can constrain necessary growth in investment, which is more likely to sustain an economy in the long run.

The U.S. gross domestic product (GDP) is the sum of consumer spending (C), investment (I), government spending (G), and net exports (NX). Since 1980, the Consumer Spending component of GDP has grown fairly dramatically, as noted in the above graph. Personal consumption expenditure (PCE) is comprised of three categories, including durable goods, non-durable goods, and services. Durable goods include items such as autos, furniture, and appliances, and they comprise 10% to 15% of PCE. Non-durable goods include items such as food, clothing, and gasoline, and they comprise 25% to 30% of PCE. Services include housing, transportation, medical care, and household operation expenses, and they comprise 55% to 60% of PCE.

Many economists point out that this trend in consumerism has led to a “crowding out” of investment and export growth. While this trend in U.S.-based consumerism provided a significant boost to the exports of developing economies such as Brazil, Russia, India, and especially China, the foundation of this GDP composition could be in the process of restructuring or retrenchment.

U.S. PCE has grown from nearly 60% to 70% of U.S. GDP since 1980. That’s approximately a 17% growth in PCE as a percent of U.S. GDP. Should this growth rate continue over the next 30 years, we could see a PCE contribution to U.S. GDP of nearly 80%. Such a level of PCE would suggest that investments, government spending, and net exports would comprise an increasingly smaller portion of GDP. However, such a growth rate and level of consumption might in fact be impossible to achieve. (Unless sovereign wealth funds and foreign central banks are willing to unflinchingly believe in the value of the U.S. dollar, and continue to finance U.S. debt. It may seem crazy, but it is possible.)

U.S. consumptions: Too much of a good thing?

This trend prompts the question—is the current trend of U.S. consumer spending sustainable? Is such a level of spending consistent with maintaining an optimal economic growth rate? Economists suggest the answer is no. Harvard economists Kenneth Rogoff and Carmen Reinhart published a fairly controversial study, Growth in a Time of Debt, noting that when countries have gross debt-to-GDP ratios exceeding 90% (the United States has 105%, Germany 82%, and Greece 160%), median growth rates fall by 1%, and average growth rates fall considerably more.

Academics differ as to the cause and effect of high debt levels. Does high debt cause low growth, or does low growth cause high debt? Regardless of cause and effect, a “new normal” of U.S. GDP growth rates falling from 2.5% to 1.5% would be problematic. This drop in GDP growth would be the likely result of “crowding out” of private investment. Plus, growth in government spending and taxation would also add pressure to crowding out investment, and eventually something has to crowd out and slow down consumption.

U.S. population growth had been around 1.20% per year post-1980, though it has slowed to a current level closer to 0.70% more recently, as the baby boomer generation passes on and both immigration and birthrates slow. If high debt levels in the United States are associated with 1% less GDP growth, perhaps half of this 1% drop in economic growth rates will coincide with the 0.5% drop in population growth rates. The drop in population growth could exacerbate the decline in GDP growth unless productivity fills the gap. On the other hand, perhaps Rogoff and Reinhart’s data surrounding high debt and low growth account for an associated decline in population growth. The challenge is that if investment is crowded out due to excess consumption and government spending or taxation in a high debt environment, that investment-related productivity growth could slow, resulting in declining standards of living and consumption.

In other words, too much consumption and too much debt could lead to real lower growth rates going forward. A shrinking labor pool equipped with greater productivity can mitigate some of these negative effects of excess consumption and high levels of debt. However, if current levels of consumption are crowding out investment in productivity growth, the U.S. economy could be facing a lower growth rate in a slower growing labor pool that has an even lower rate of productivity growth. That means slower GDP growth rates going forward, as well as declining purchasing power for the U.S. consumer.

Plus, while the Federal budget deficit has shrunk from 10% to nearly 4% post-2008 crisis and is expected to stabilize during the next few years, the future liability of entitlements in the following decade of 2020–2030 presents an enormous financial challenge for the children and grandchildren of the baby boomer generation. The healthcare, medicare, and social security obligations in the future will require a robust and productive labor force to generate sufficient tax revenue to meet these obligations. In the current environment, prior Federal Reserve Chairman Alan Greenspan sees “an extraordinary set of pressures which say to me that by, say, 2030, government will not be able to fulfill the promises now legally on the books in real terms.”

Outlook

The SPY hit a 2009 low of around 69, though it nearly doubled to 117.00 by August 23, one year ago. Over this same time, the iShares Russell 2000 Index (IWM) rallied from 35 to about 80, more than doubling. Since August 2012, the SPY has been up 18%, while IWM has been up nearly 28%. The broad based Russell 2000 Index includes smaller companies than the S&P, and may reflect a greater sensitivity to the U.S. domestic economy than the larger, global blue chip companies in the S&P. Should investors see weaker consumption, investment, and government spending soften GDP growth in the future, they may wish to consider limiting excessive exposure to the U.S. domestic economy, as reflected more completely in the iShares Russell 2000 Index (IWM), or consider more defensive consumer staples as reflected in the iShares Russell 1000 Value Index (IWD), as discussed in the previous article in this series.

RELATED ARTICLES BY COUNTRY

-

CHINA: For further analysis of how CHINA could be affected by slowing consumption in the USA please see CHINA SERIES—“The Golden Age of Cheap Labor Coming to an End?”

-

JAPAN: For further analysis of how JAPAN’s export-led recovery could be affected by USA-based consumption trends, please see JAPAN SERIES, “Why Japanese Exports Could Break Out of a 5-Year Slump in 2013.”