Mortgage servicing rights increase in value as interest rates rise

Mortgage servicing rights are one of the few financial assets that increase in value as rates rise Most mortgage REITs are exposed to changes in interest rates, and are usually long-duration, which means that the value of their portfolio decreases in value as interest rates rise. Good examples of these types of REITs would be […]

Nov. 20 2020, Updated 3:53 p.m. ET

Mortgage servicing rights are one of the few financial assets that increase in value as rates rise

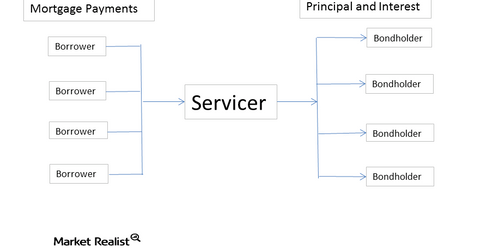

Most mortgage REITs are exposed to changes in interest rates, and are usually long-duration, which means that the value of their portfolio decreases in value as interest rates rise. Good examples of these types of REITs would be Annaly (NLY), American Capital Agency (AGNC), MFA Financial (MFA), Hatteras (HTS), or Capstead (CMO). However, there are some REITs that not only purchase mortgage-backed securities, but also purchase mortgage servicing rights. Examples of these companies would be Nationstar (NSM) and Ocwen (OCN). Mortgage servicing rights are an interesting type of financial asset in that their value increases as interest rates increase. This makes them a good hedge for investors who have a portfolio of mortgage REITs that are declining as interest rates rise.