Ocwen Financial Corp

Latest Ocwen Financial Corp News and Updates

Mortgage servicing rights increase in value as interest rates rise

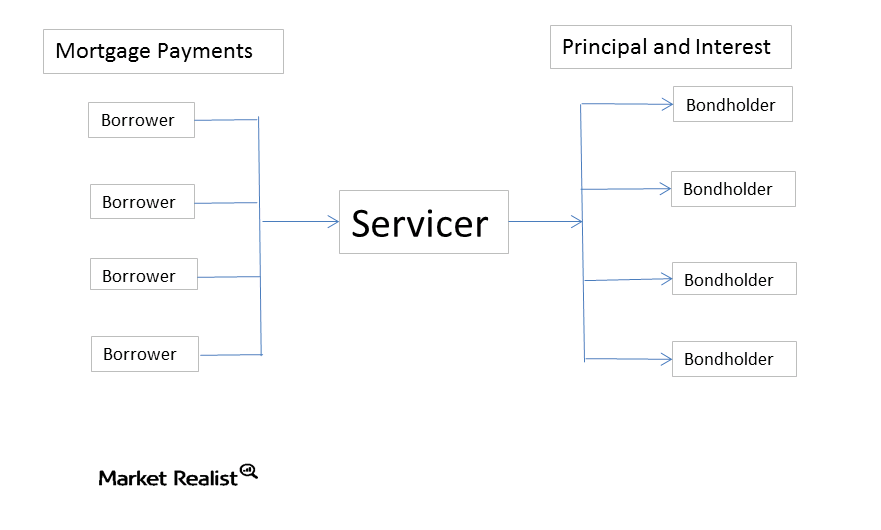

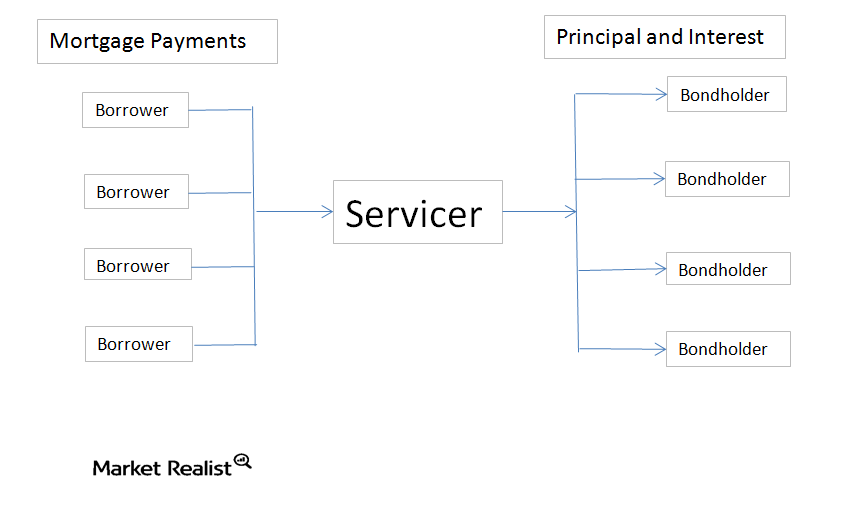

Mortgage servicing rights are one of the few financial assets that increase in value as rates rise Most mortgage REITs are exposed to changes in interest rates, and are usually long-duration, which means that the value of their portfolio decreases in value as interest rates rise. Good examples of these types of REITs would be […]

Why mortgage servicing rights imply risks for servicers

Risks of being a servicer Generally, servicing seems like an easy job. Collect the payment, give the government its take, pass the (smaller) payment to the bondholders, and keep the rest. What could go wrong? There’s just one catch. What happens if you miss your mortgage payment? The U.S. government guarantees Ginnie Mae securities. When […]