Hatteras Financial Corp

Latest Hatteras Financial Corp News and Updates

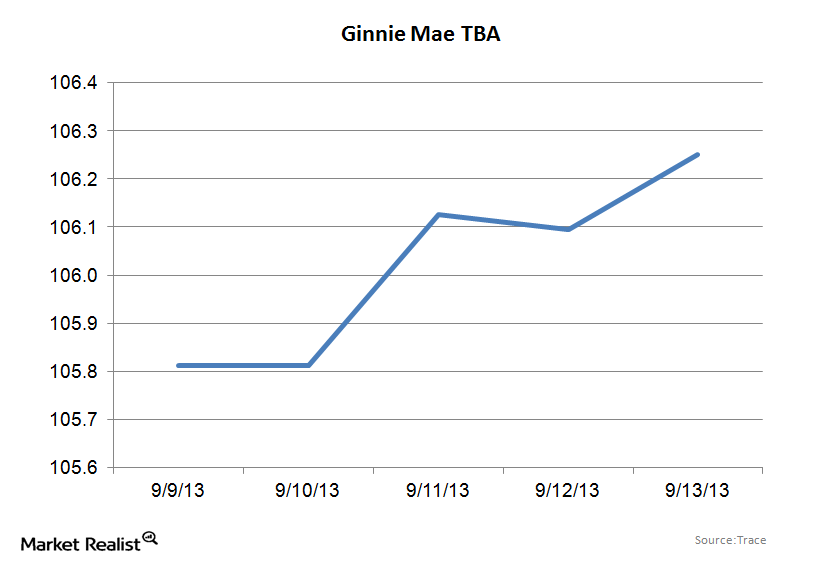

Ginnie Mae TBAs rally before the Fed meeting

Mortgage-backed securities are the starting point for all mortgage market pricing and the investment of choice for mortgage REITs When the Federal Reserve talks about buying mortgage-backed securities, it’s referring to the To-Be-Announced (also know as the TBA) market. The TBA market allows loan originators to take individual loans and turn them into a homogeneous product […]

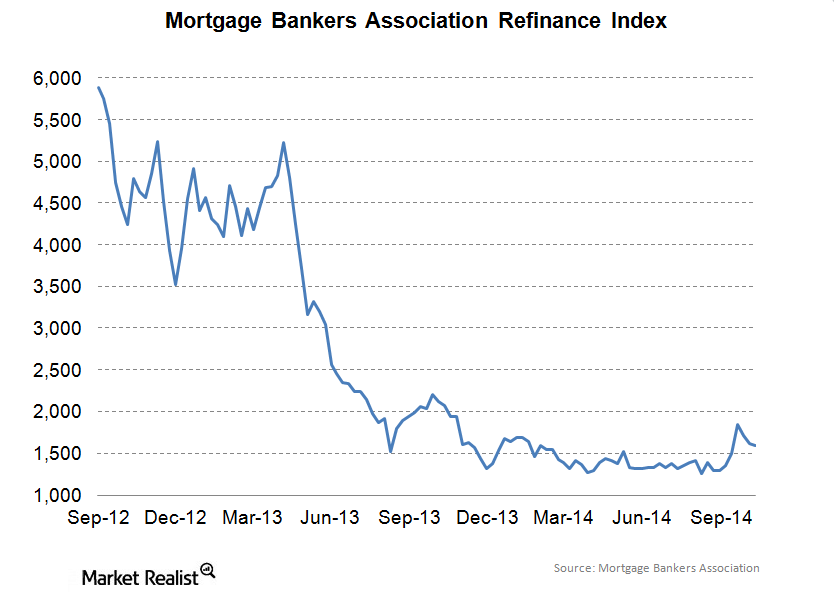

The End Of Quantitative Easing Could Make Mortgage REITs Vulnerable

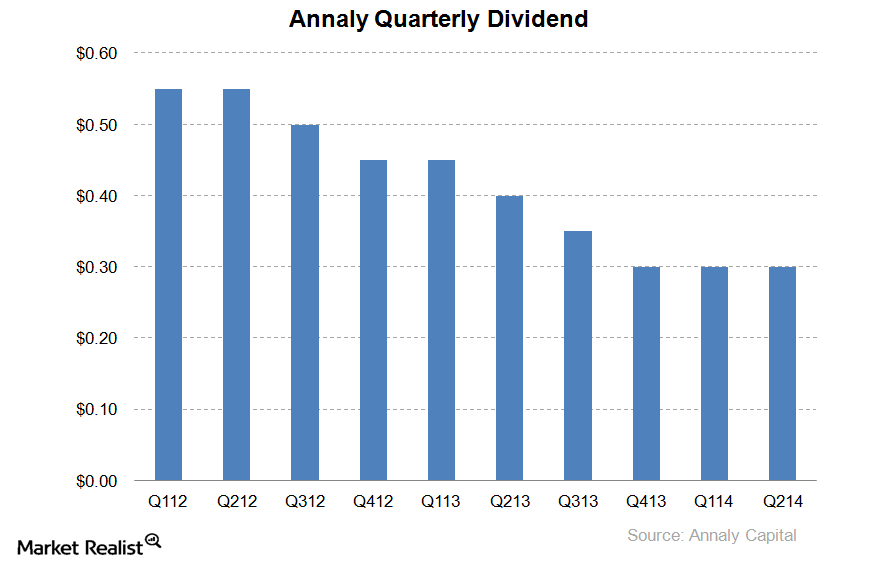

Big agency REITs like Annaly (NLY) and American Capital Agency (AGNC) took the chance to deleverage their balance sheets after the warning in the spring of 2013.

Primer on mortgage backed securities, Part 5

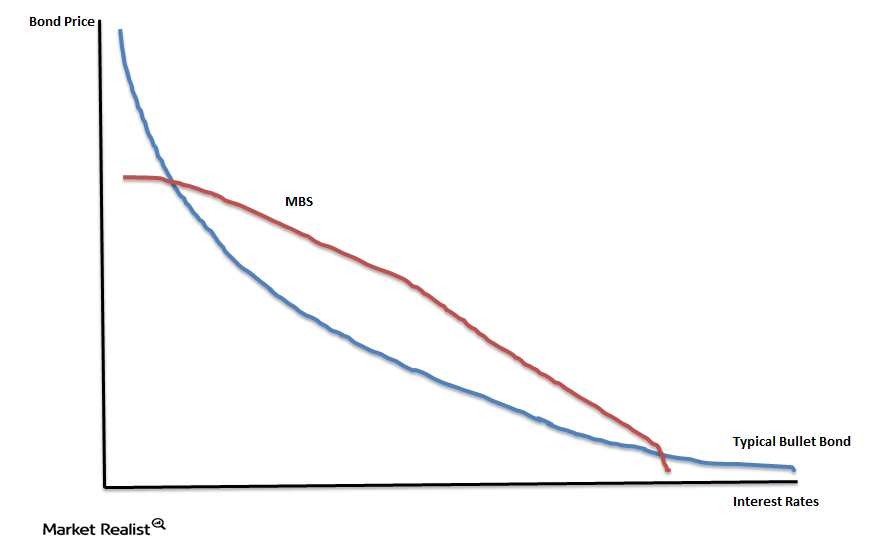

Continued from Primer on mortgage backed securities, Part 4. Prepayment risk Prepayment risk and interest rate risk go hand-in-hand. The main difference between a mortgage backed security and a government bond is that with a government bond, you know exactly when you will get your principal and interest payments. If you purchase a 7-year Treasury […]

Primer on mortgage backed securities, Part 1

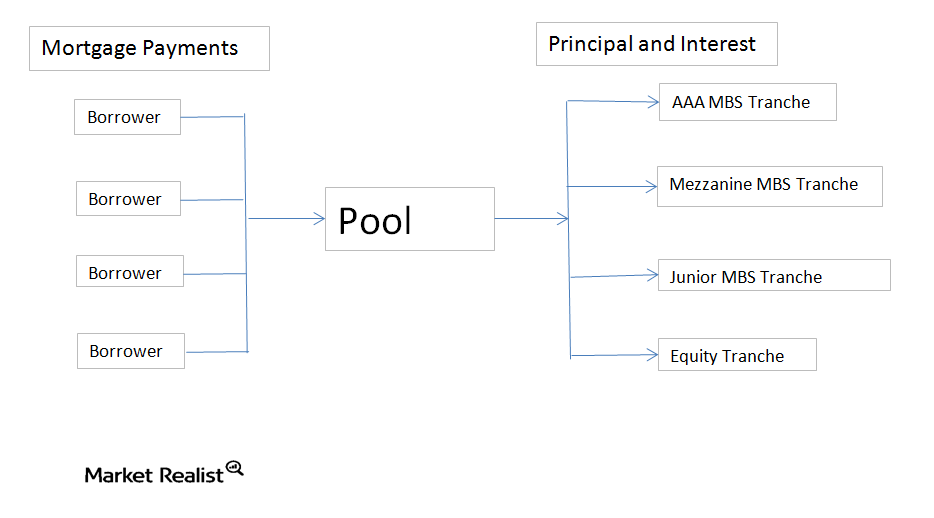

What are mortgage backed securities? Mortgage backed securities are pools of individual mortgages that have similar characteristics. They allow a relatively illiquid asset (an individual home mortgage) to be converted into a very liquid asset that can be traded with relative ease. They also allow an issuer to divide up the cash flows in order […]

Annaly CEO Wellington Denahan shares her vision for the future

On the company’s conference call to analysts and investors, Annaly CEO Wellington Denahan addressed the current interest rate environment and where she saw the company heading in the future.