Comparing the Great Depression’s housing bear market with today’s

The real estate bubble of the 2000s was bigger than the real estate bubble of the 1920s In many ways, the dual stock market and real estate bubbles of the 1920s were a mirror image of the 2000s market collapse. The 1920s real estate boom peaked in 1925, and the stock market collapsed four years […]

Aug. 27 2013, Published 12:53 p.m. ET

The real estate bubble of the 2000s was bigger than the real estate bubble of the 1920s

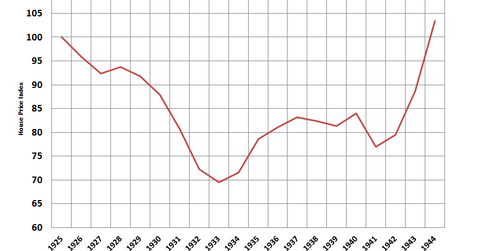

In many ways, the dual stock market and real estate bubbles of the 1920s were a mirror image of the 2000s market collapse. The 1920s real estate boom peaked in 1925, and the stock market collapsed four years later. During the 2000s, the stock market peaked in 2000 and the real estate bubble burst five years later. The 2000s real estate bubble inflated 135%, while the 1920s bubble only inflated 50%. The U.S. real estate bubble bottomed (we think) about six years after the peak; the Great Depression bust ended in 1933, about eight years after. The peak-to-trough decline in the ’20s was 30%, while the decline in the ’00s was 33%. Real estate prices didn’t reach their 1925 levels until 1944, almost 20 years later.

Variation in financing drove the difference

The 30-year fixed-rate mortgage that Americans take as a birthright didn’t exist in the 1920s. Back then, mortgages resembled a typical corporate bond—they had a five-year term, and the borrower paid interest only and then had a balloon payment when they were to be refinanced. This meant the entire mortgage market had to roll over every five years, which was almost impossible due to the crisis. Mortgages that couldn’t be refinanced ended up in foreclosure and the properties were dumped onto the market.

The role of securitization

The use of securitization came out of the Great Depression. Prior to the Great Depression, local banks largely served their communities, and if the local community suffered an economic shock—like an employer going out of business or a weather-related problem—the entire bank’s customer base would have problems all at once. This put undue risk on the bank but also left the community with no source of credit if the bank started having problems. Securitization allowed lenders from outside the area to provide capital to borrowers within the community. It also allowed the local bank to lay off some of its geographic risk .

What are bubbles?

Bubbles are psychological phenomena. First, during the 2000s, people believed that real estate prices couldn’t fall—and aside from the Great Depression, they hadn’t. We would go on to experience mini-bubbles in places like California and Texas during the 1980s, but we had not experienced a nationwide real estate crash since the 1930s. Second, Wall Street believed that diversification would bail it out if there were a crash in overheated markets like Phoenix or Las Vegas. People would never have made most of these securitizations if they had assumed the higher correlation rates that we experienced. Given that psychology is a major part of bubbles, fears that we’re creating another real estate bubble are overblown. Homebuilders like Toll Brothers (TOL), Lennar (LEN), and KB Homes (KBH) don’t have to worry that they’re sitting on land and homes that are about to collapse. Prices have increased but are really just rebounding off the bottom. People now know that real estate can fall. We may never experience another residential real estate bubble, but our grandkids might.